Oct 18, 2019

Are SUVs Cooking the Planet?

, Bloomberg News

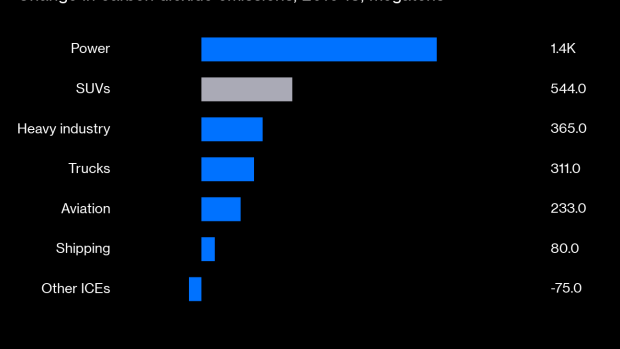

(Bloomberg Opinion) -- A worldwide preference for bigger, heavier cars has led to a nearly sixfold increase in the number of SUVs on the road since 2010 — and made them the second-biggest contributor to the rise in carbon dioxide emissions, the International Energy Agency reported this week. Only power generation is causing a bigger increase in emissions.

SUVs are also the reason that oil demand from passenger cars has grown by 3.3 million barrels a day since 2010, while oil use from other kinds of cars has declined slightly.

These findings are dramatic, but there’s both less and more to them than IEA’s analysis reveals.

Here’s the less: Yes, SUVs are responsible for 544 million tons of CO2 emissions from 2010 to 2018. The above chart shows the absolute increase in emissions caused by the SUV fleet expansion. Absolute emissions from SUVs are compared only to the amount from no new vehicles at all — that is, to zero.

However, a consumer’s choice is rarely to buy an SUV or nothing — it’s to buy an SUV or some other vehicle. And it’s important to take this into account when assessing additional fuel consumption and emissions. When IEA analysts did so, they told me via email, they found that SUVs drove up oil use over the past eight years by only about half a million barrels a day.

In absolute terms, then, SUVs are responsible for all the new oil demand from passenger cars; in relative terms, the increase in demand is only about 15% more than what it would have been if buyers had chosen medium-sized cars.

Now here’s where the IEA’s analysis underestimates the effect of SUVs: It says that the bigger vehicles “consume about a quarter more energy than medium-sized cars.” In terms of emissions, however, the difference is more than a quarter — in some places, much more. BloombergNEF analysis has found that emissions per SUV per year are 47% higher than emissions from a small car in the US. In China, that difference is lower — only 28% — but in Europe it’s as high as 87%.

The combination of a growing global vehicle fleet and a growing preference for bigger cars means that emissions from liquid road fuels can be expected to keep rising through the end of the 2020s. After that, increasingly stringent efficiency standards and more and more electric vehicles will cause emissions to fall. The net result isn’t great: Annual emissions will rise by more than 700 million tons before falling back to where they are today — and not until 2040.

The changes that SUVs have made to fuel consumption and emissions look to be locked in for at least a decade, because today’s new cars remain on the road so long. That makes lowering emissions from road transport harder than ever.

Weekend reading

Quartz asks “some of the boldest thinkers” what the world will be like in 50 years.

Sustainable debt issuance has topped $1 trillion since the green bond market was born in 2007.

A new Climate Bonds Initiative report says central banks and financial regulators can and should play a role in developing climate risk policy.

The Federal Reserve Bank of San Francisco has published 18 papers on the financial risks of climate change.

We need new agricultural practices to improve the health of vital insects while eliminating pests in a natural and sustainable manner.

The Economist explains how to make use of all of a tree.

The 2019 State of Food and Agriculture Report looks closely at food loss and food waste.

California averted a collapse in the 2000s, but it’s in trouble again.

Awaiting socialism’s collapse in the Caracas Country Club.

Qatar has begun air-conditioning its outdoor spaces.

Uzbekistan witnesses an electronic dawn.

To contact the author of this story: Nathaniel Bullard at nbullard@bloomberg.net

To contact the editor responsible for this story: Mary Duenwald at mduenwald@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Nathaniel Bullard is a BloombergNEF energy analyst, covering technology and business model innovation and system-wide resource transitions.

©2019 Bloomberg L.P.