Apr 26, 2021

AstraZeneca’s shot designer seeks US$613 million value in IPO

, Bloomberg News

We think AstraZeneca is undervalued: Director of healthcare equity research

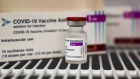

The University of Oxford spinoff that designed AstraZeneca Plc’s COVID-19 vaccine is seeking a valuation as high as US$613 million in its initial public offering in the U.S., a move to help fund trials for new directions in cancer and other diseases.

Vaccitech Plc is set to offer 6.5 million American depository shares for as much as US$18 each and will be listed on the Nasdaq Stock Exchange, according to a filing with the U.S. Securities and Exchange Commission. The company, which will trade under the VACC ticker, will use the proceeds to advance the development of vaccines for hepatitis B virus, human papillomavirus and prostate cancer.

The rush to develop shots that prevent COVID-19 has put vaccine developers around the world in the spotlight. While not yet cleared in the U.S., the Astra vaccine has been seen as a key to halting the pandemic around the world because of its low price and ease of storage at refrigerator temperatures.

Vaccitech is part-owned by Adrian Hill and Sarah Gilbert, the scientists who led the development of Astra’s COVID vaccine, based on their research into viral-vector tools. Each owned about 5.2 per cent of the company in January, according to a Companies House filing.

A number of European biotechnology and life sciences companies have listed on the Nasdaq, seen by many investors as the prime spot for the world’s most innovative technology companies. They include Autolus Therapeutics Plc and Orchard Therapeutics Plc, both spinoffs from University College London, in 2018. ADRs of BioNTech SE, the German co-developer of the messenger RNA COVID vaccine with Pfizer Inc., trade at more than 10 times the price at which the company listed on the exchange in 2019.

In March, DNA sequencing firm Oxford Nanopore Technologies Ltd., whose offices are close neighbors of Vaccitech’s in Oxford’s Science Park development, announced it would list on the London Stock Exchange. That’s bucked the trend and was a boost for the U.K. government’s plans to make the country a science hub after Brexit.

A funding round in March backed by M&G Investment Management, Tencent, Gilead Sciences Inc., Monaco Constitutional Reserve Fund, Future Planet Capital and Oxford Sciences Innovation raised US$168 million for Vaccitech.