Jan 31, 2019

AT&T notches dubious achievement with its first wireless subscriber loss

, Bloomberg News

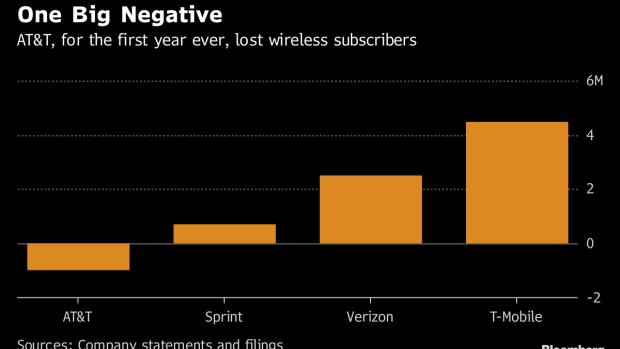

When the big wireless carriers reported their results this week, AT&T Inc. (T.N) stood out for the wrong reason: It was the only one to lose wireless subscribers.

In the process, AT&T achieved a dubious milestone. For the first time in history, it ended the year with fewer regular monthly mobile subscribers than it started with.

Call it unfortunate roadkill on a much bigger journey. To become the media giant it is now, AT&T had to spend US$85 billion to buy Time Warner, home to Warner Bros.’s “Aquaman” and HBO’s “Game of Thrones.” Along the way, AT&T amassed an US$180 billion mountain of debt that risked a potential credit rating downgrade. To keep lenders happy, AT&T has been channeling more cash toward reducing debt.

That means the accountants have sharpened pencils and checked off boxes looking for spending cuts and fatter profits. No more deep discounts on phones, no more free introductory periods for service plans. In other words, no costly promotions in the fight for new customers.

AT&T also blamed the decline of roughly 620,000 subscribers on shrinking demand for iPads and other tablets, a trend across the industry.

The company says it isn’t starving its businesses to pay off debt, but AT&T has stopped the unprofitable promotions that other carriers offer. And in addition to the US$9 billion spent reducing debt last quarter, the company says it is investing in areas like 5G.

While bondholders might feel relief about the frugal strategy, shareholders are less excited. AT&T shares are down 20 per cent to US$30.06 over the past 12 months.