Apr 4, 2023

Australia Pauses Tightening Cycle Amid Economic Uncertainty

, Bloomberg News

(Bloomberg) -- Australia’s central bank paused its almost yearlong tightening cycle, highlighting policy lags and a “substantial” slowdown in household spending while keeping the door open to further interest-rate increases.

The currency and government bond yields slid after the Reserve Bank on Tuesday kept the cash rate unchanged at 3.6%, in line with a majority of economists and market expectations. Governor Philip Lowe also pointed to bank stress in the US and Europe as adding to headwinds for the global economy.

“The board has still retained a hiking bias,” said Gareth Aird, head of Australia economics at Commonwealth Bank of Australia. “But it is a more watered down version of the previous statement.”

Lowe said in today’s statement that the RBA expects “some further tightening of monetary policy may well be needed.” The introduction of “some” and the governor replacing last month’s “will” with a “may” suggest a toning down of the tightening bias.

The decision reinforces the RBA’s status as a policy outlier, adopting a more dovish approach than the Federal Reserve and the European Central Bank. Those two heavyweights last month pushed ahead with rate hikes in the face of global financial market volatility triggered by bank collapses and bailouts.

The Australian dollar declined to 67.61 US cents after the decision, while the yield on policy-sensitive three-year bonds extended a drop, falling as much as 11 basis points to 2.87%. In contrast, stocks erased losses as business and consumer groups welcomed the pause after 10 consecutive rate hikes.

The decision may help boost sentiment toward global bonds as traders reassess the conviction of policymakers to keep tightening in economies that are clearly weakening. Swaps traders brought forward the likely start of an RBA easing cycle to November from December.

Among reasons to pause, Lowe highlighted the string of rate increases already delivered and high inflation that are “leading to a substantial slowing in household spending.” He added that some households are “experiencing a painful squeeze on their finances.”

Lowe will speak Wednesday at the National Press Club in an address titled “Monetary Policy, Demand and Supply.” He is likely to use the speech to expand on the RBA’s assessment of the economic outlook and its intentions.

What Bloomberg Economics Says...

“The RBA’s decision to pause on rates in April increases the likelihood that hikes are now over. Data in coming weeks could make it increasingly clear that conditions have deteriorated enough to shift the RBA’s focus from combating inflation to supporting growth next year”

— James McIntyre, economist.

To read the full report, click here

The RBA has raised rates by 3.5 percentage points since last May, less than New Zealand’s 4.5 points — which is expected to rise by another quarter-point on Wednesday — and the US’s 4.75 points.

Australia’s smaller increases reflect Lowe’s efforts to both bring down inflation and keep some of the labor market gains achieved during the ultra-low rate period of the pandemic.

While Lowe has acknowledged the path to a soft landing is “narrow,” his determination to do so is part of the reason why economists expect Australia will avoid a recession.

“The board holds a tightening bias, but it does not read with much conviction,” said Jo Masters, chief economist at Barrenjoey Markets Pty Ltd, who now predicts the cash rate will remain at 3.6% until May next year.

“We expect the RBA will revise growth lower and bring forward a 3% inflation rate” when forecasts are updated next month, she said.

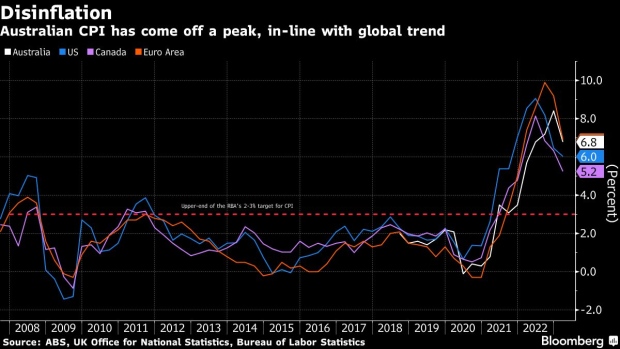

Many economists altered their rate call from a hike to a pause after inflation slowed to 6.8% in February from 7.4% in January.

That still outpaced readings in the US and Canada and sticky inflation is among reasons Deutsche Bank AG and Goldman Sachs Group Inc. forecast a terminal cash rate of 4.1%, implying another two quarter-point hikes.

While money market pricing implies the RBA’s tightening cycle is concluded, the Reserve Bank of New Zealand anticipates that its rate will hit 5.5% this year. The RBNZ is likely to hike by a quarter-point to 5% on Wednesday.

Fed rate forecasts show a median estimate of about 5.1% at the end of 2023, close to its current 5% upper bound. The RBA doesn’t provide a forecast for the future path of rates.

“The fact that the central bank paused today underscores their concerns over the growth outlook, and the lagged effects of the monetary tightening,” said Oliver Levingston, a rates strategist at Bank of America in Sydney. “This points to a high bar for the RBA to resume hikes.”

--With assistance from Brett Miller, Matthew Burgess and Tomoko Sato.

(Adds comments from Barrenjoey.)

©2023 Bloomberg L.P.