Apr 14, 2021

Avis Soars as Lofty Car-Rental Demand Meets Shortage of Supply

, Bloomberg News

(Bloomberg) -- Avis Budget Group Inc. is on a tear. The car renter’s stock hit fresh record highs on Wednesday as an economic reopening that’s boosting travel demand collides with industrywide inventory tightness.

Shares of Parsippany, New Jersey-based Avis rose 2.2% to $77.50 as of 2:54 p.m. in New York. The stock is up more than 100% this year through Tuesday’s close and almost 900% since a pandemic low of $7.78 in March 2020.

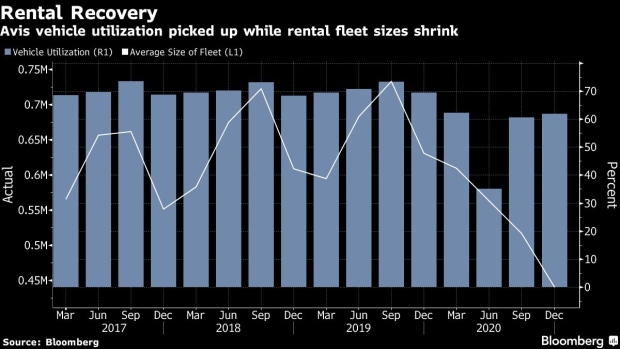

The industry is raising prices as post-vaccination business and leisure travel surges and household-name rental companies don’t have enough cars for customers to drive off the lot. The firms are adding cars back to their fleets, but cautiously. During the early months of the pandemic, Avis and rivals Hertz Global Holdings Inc. and Enterprise Holdings Inc. sold large portions of their inventory and cut costs severely to shore up finances as U.S. travel ground to a halt.

Now, their ability to restock cars is also being hampered by automakers pausing production due to a global semiconductor shortage. Automakers’ sales to fleet customers fell about 30% in the first quarter, according to analyst estimates. Carmakers are seeing nascent signs of increased fleet demand but are prioritizing sales to higher-margin retail buyers.

Read More: Automakers Notch Sales Bounce a Year After Covid-19 Onset

“Fleet is definitely coming back,” Judith Wheeler, Nissan Motor Co.’s vice president for U.S. sales, said in an interview April 1. “We will try to do our part to give them some inventory, but we’re going to focus on retail.”

Even so, Avis shares continue to soar as main rival Hertz faces restructuring from bankruptcy and analysts see tailwinds from the pandemic lasting into the second half of this year.

“The rental-car companies all took inventories down. As the country is opening up, they don’t have any cars,” Maryann Keller, an independent auto consultant and former board member of Dollar Thrifty, said in an interview. “People are going to pay a lot more than they did before for the foreseeable future. Rental traffic is up quite a bit.”

Rental companies, she added, “will make a lot of money.”

Car-rental volumes likely rose in March as both web traffic and pricing rose, Jefferies analysts led by Hamzah Mazari wrote in a note to clients on April 7. Jefferies, which scrapes company websites for pricing data using a proprietary model, found Avis prices had risen 8% on a like-for-like basis in March from a year earlier. By comparison, it found Hertz’s prices were up 15% year-on-year that month. Overall web traffic was up 3% in March compared with pre-pandemic 2019. In February, web traffic was still 13% lower versus the same period in 2019.

“The market is obviously reacting to what this industry structure will look like post-Covid,” Mazari, who has a buy rating and $55 price target on Avis, said in an interview Wednesday. “The sector isn’t adding back a lot of cars. The fleets are very tight relative to demand.”

Jefferies expects Avis to return to pre-Covid revenue levels in 2023 and industry fleet levels to normalize as early as the fourth quarter. At around $78 a share, Avis’s stock trades at a 37% premium to analysts’ average 12-month price target of $56.80.

Hertz, one of Avis’s main global competitors and for now the only other publicly traded car-rental stock, filed for bankruptcy in May. Earlier this month, Hertz accepted an “enhanced” offer from Centerbridge Partners, Warburg Pincus and Dundon Capital Partners to provide equity capital for the company’s exit from Chapter 11. Its shares, which traded down 7.3% to $1.15 on Wednesday, are slated to be wiped out as part of the bankruptcy reorganization.

Read More: Hertz Picks Centerbridge-Backed Plan to Exit From Bankruptcy

Avis is well-positioned to benefit from the recovery in travel demand as well as higher used-car prices, Morgan Stanley analyst Adam Jonas wrote in a note to clients April 7. Traditionally, car-rental companies will hold onto new vehicles for 12 to 18 months before auctioning them off or selling them direct to consumers. A higher price on resale means a lower overall cost to maintain their fleets. In prior recessions, lower pricing and weaker markets for used vehicles have hurt rental companies.

©2021 Bloomberg L.P.