Dec 1, 2023

Bank Bonuses Climb 9% in Canada, at Odds With Bay Street Blues

, Bloomberg News

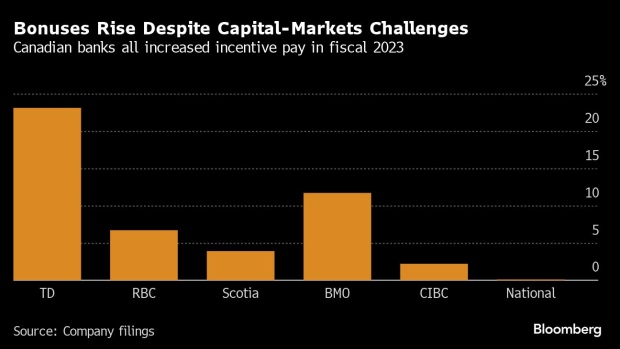

(Bloomberg) -- Canada’s largest banks set aside 9% more on average for bonuses in fiscal 2023 than they did a year earlier, with increases at all six companies despite a broadly disappointing year for dealmaking.

That increase is somewhat at odds with the mood on Bay Street, according to Bill Vlaad, managing partner and chief executive officer of Toronto-based recruitment firm Vlaad & Co., who called the equities market of the past six months “abysmal” and said most people in the capital-markets business have been bracing for much lower bonuses.

“We’re getting early indications and people are getting hammered,” he said in an interview Friday, noting that many people his firm speaks with have been saying for months they expected a bad year for bonuses.

Employees in other divisions, such as wealth management, insurance and asset management, also receive variable compensation on top of their base salaries, and those payouts are included in the overall numbers the banks report, which are not broken down by business line.

But capital-markets professionals — including investment bankers, analysts, salespeople and traders — typically count on a much larger portion of their take-home pay coming from bonuses. Capital-markets employees don’t account for the majority of employees at many banks, so lower bonuses in those businesses may not drag down the overall numbers, Vlaad said.

Incentive pay at Canadian banks — which doesn’t include base salaries — is based on performance, and the figures the firms report reflect the amount reserved, not paid out. The fiscal year ended on Oct. 31, but bonuses are typically distributed in December.

Those figures range from a very small increase at National Bank of Canada to a whopping 23.1% spike at Toronto-Dominion Bank, which acquired New York-based financial services firm Cowen Inc. earlier this year.

Revenue production was down across the board this year in capital markets, “whether you look at mergers and acquisitions, IPOs, financing activity, debt capital markets — you name it,” said Vlaad and Co. President Mark Stipe.

Stipe said his firm has been hearing that bonuses for those at the managing-director level could be down by as much as 25%, while analysts were likely to be better protected from big declines, with incentive pay down about 5% to 10%.

Here’s a breakdown of bonus reserves by bank:

Toronto-Dominion Bank

Toronto-Dominion, Canada’s second-largest lender by assets, set aside C$4.07 billion ($3.01 billion) for incentive compensation, an increase of 23.1%, making it the bank with the largest hike.

Adjusted net income across the bank fell 1.8% last year and plunged 17% to C$1.12 billion in its capital-markets business. But the bank pointed to a number of other factors that drove the growth in its bonus pool, including its acquisition of New York-based financial-services firm Cowen Inc., a deal that closed in March.

“This year’s incentive is a product of a combination of factors, including year-over-year increases in full-time employees from the acquisition of Cowen Inc., salary increases (including employees) and the foreign-exchange impact of the weakening Canadian dollar on US segment incentive-compensation expenses,” spokesperson Elizabeth Goldenshtein said in an email. “These factors were partially offset by lower financial performance compared to 2022.”

Royal Bank

Royal Bank of Canada, which has the largest capital-markets business among Canadian banks — including a significant US franchise that ranks No. 9 in the global league tables — increased variable compensation 6.7% to C$7.61 billion.

On an analyst call earlier this week, Chief Financial Officer Nadine Ahn pointed to an increase in earnings at Royal Bank’s capital-markets business in the fourth quarter — where activity in the US was strong — which helped boost the unit’s profit for the year to C$4.14 billion, a 23% increase, making it an outlier in the group.

“Results this quarter reflected record fourth-quarter revenue underpinned by market-share gains across investment banking and global markets,” Ahn said.

Bank of Nova Scotia

Bank of Nova Scotia posted a more modest increase in performance-based compensation for the year, boosting money set aside for bonuses by 3.9% to C$2.08 billion despite a drop in overall adjusted net income for the year.

Chief Financial Officer Raj Viswanathan said the increase was due to a number of variables, “including the bank’s ability to deliver for our shareholders, our performance relative to peers and, of course, individual performance.”

“Our all-bank performance-based compensation this year reflects challenging market conditions and an uncertain macroeconomic outlook,” he said in an email. “However, we believe employees are our most important asset, and recognizing our employees through variable compensation is one of the many ways we reward their valued contributions.”

Canadian Imperial Bank of Commerce

With adjusted net income down slightly to C$6.5 billion for the year, Canadian Imperial Bank of Commerce increased its bonus pool by 2.2% to C$2.51 billion. The bank’s capital-markets division saw adjusted net income increase by 4% to C$1.99 billion.

“We think we did a lot of things well” in 2023, Chief Financial Officer Hratch Panossian said in an interview. “It was a balanced year, and our compensation reflects that.”

Bank of Montreal

Bank of Montreal increased its incentive compensation pool by 11.7% to C$3.57 billion in fiscal 2023. Its capital-markets business was down slightly for the year, but rose in the fourth quarter.

“Our compensation framework is designed to deliver long-term shareholder performance, is a reflection of business results and is competitive with the market,” spokesperson Jeff Roman said in an email.

National Bank of Canada

Montreal-based National Bank of Canada, which depends on capital markets for a high proportion of earnings, increased bonus payments by just 0.1% to $1.34 billion.

While the bank posted higher capital-markets profit than expected in the fourth quarter, the division’s earnings for the full year were down slightly from fiscal 2022.

A National Bank representative declined to comment on the firm’s bonus payments.

©2023 Bloomberg L.P.