Sep 1, 2022

Bank CFOs weigh in as corporate loans face test in Canada

, Bloomberg News

Invest in banks, short-term bonds and gold miners in these bear market rallies: Gavin Graham

Finance chiefs of some of Canada’s largest banks are assessing how long strong demand for loans can continue even as the country’s economy shows signs of losing momentum.

Companies’ use of credit facilities have helped to finance their post-pandemic investments while shielding them from the highest rates in 13 years in the bond market. That in turn has been a fresh source of business for lenders at a time when other desks, including capital markets, run at the slowest pace in several years.

This virtuous circle faces a key test, however, as global economic and geopolitical uncertainties threaten the trajectory of domestic growth. In interviews with Bloomberg News, top finance executives in the North American market weighed in on the current state of play:

- “This is a period of time when commercial lending tends to be strong. The big question is whether higher and higher interest rates will start having an impact on broader economic growth and if that economic growth eventually translates into softer demand for loans. We are right in the middle of reading the tea leaves and building our plans for next year.” -- Bank of Montreal Chief Financial Officer Tayfun Tuzun.

- “There was a period there of the debt capital market being a little bit less accessible. So we did see large corporates utilize their bank credits more. That seems to be turning with the debt capital market being more available going forward.” -- Canadian Imperial Bank of Commerce Chief Financial Officer Hratch Panossian.

- “We’ve seen a slight increase in utilizations, but nothing that is reverting back to the pre-pandemic levels. Clients are still sitting on a surplus amount of liquidity. When we look ahead, we do expect that liquidity to start being utilized.” -- Royal Bank of Canada Chief Financial Officer Nadine Ahn.

- “Utilization levels are still not at the pre-pandemic level yet, but they are improving. A lot of that is being used to build up inventory,” adding while the use of corporate credit lines is expected to keep growing, “the outlook is quite uncertain.” -- Toronto-Dominion Bank Chief Financial Officer Kelvin Tran.

- “There’s multiple ways you can finance yourself. We’re watching that very closely, but if you want to go for duration 10, 15, 20 years, there’s nothing that beats the bonds right now.” -- Alimentation Couche-Tard Inc.’s Chief Financial Officer Claude Tessier. The company, whose fiscal first quarter earnings came in stronger than analysts expected, is looking to expand its footprint especially in the US and Europe via acquisitions.

The Canadian economy expanded at 3.3 per cent in the second quarter compared to 4.4 per cent of the median consensus estimate compiled by Bloomberg. Non-financial companies’ mortgage and non-mortgage loans rose to $1.19 trillion (US$905 billion) at the end of June, up 2.73 per cent compared to March, according to data compiled by Canada’s statistics agency. In contrast, debt securities outstanding declined 0.2 per cent to $678.9 billion.

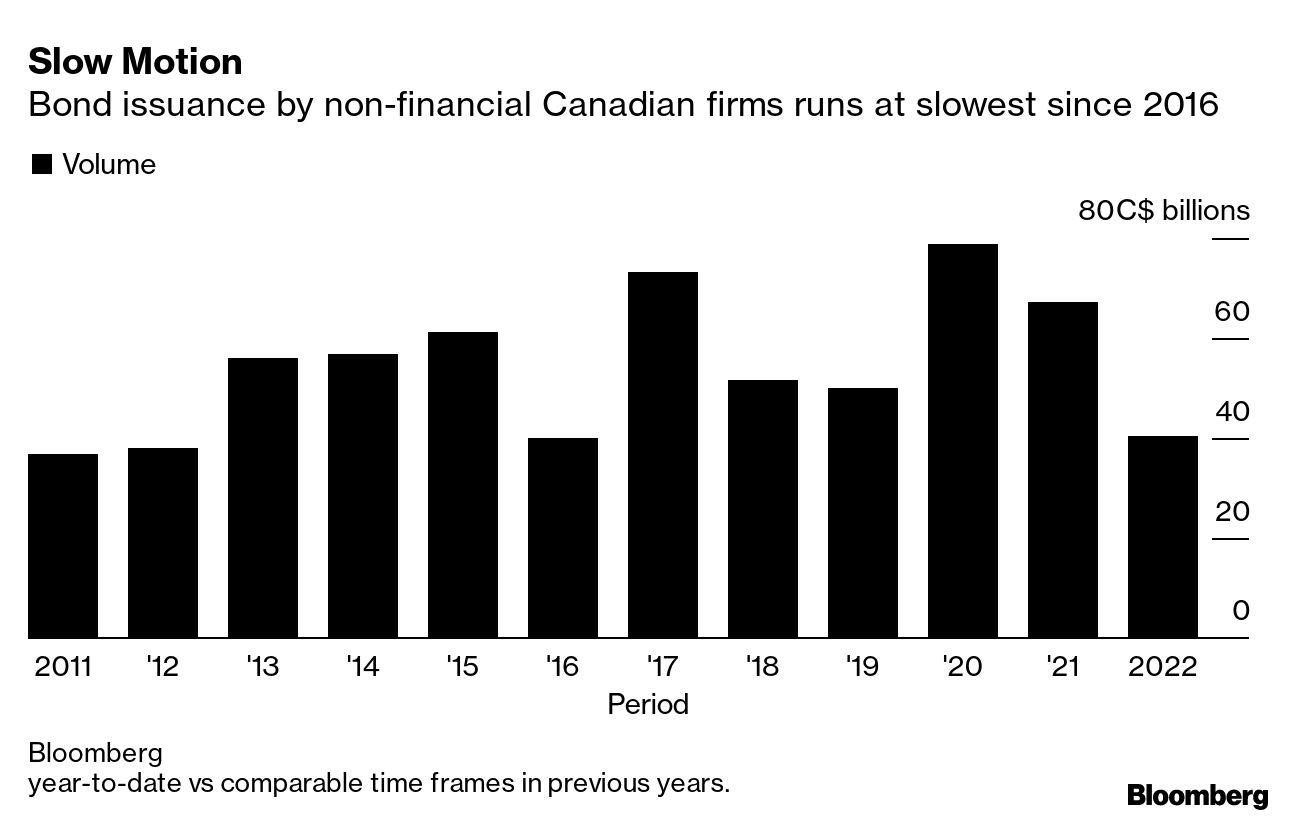

Issuance of widely marketed non-financial corporate debt in domestic and international bond markets is running at $40.5 billion so far this year, according to data compiled by Bloomberg. That’s the lowest volume since 2016 and compares to over $67 billion in the same period a year earlier.

The yield investors demand to hold investment-grade corporate bonds has more than doubled so far this year, reaching 5.14 per cent on June 14, the highest since 2009, according to Bloomberg indexes. While the metric eased in July to as low as 4.4 per cent, it’s steepening again and hit 4.94 per cent Wednesday as central banks led by the US Federal Reserve signal more interest rate hikes in their fight to check consumer inflation.

While bond yields overall remain at elevated levels, paradoxically -- considering the economic and political uncertainties -- demand for debt due in 10 or more years has attracted several investment-grade companies such as Loblaw Cos. and 407 International Inc. in recent weeks. That’s in part because the Canadian government yield curve, the benchmark used to price fixed rate bonds, is inverted.