Jan 22, 2024

Bank of Japan Keeps Negative Rate on Hold, Nudges Yen Weaker

, Bloomberg News

(Bloomberg) -- Bank of Japan Governor Kazuo Ueda kept investors in the dark over when he will scrap the world’s last negative interest rate while leaving little doubt that a move is in the pipeline.

The BOJ maintained its -0.1% short-term rate and kept its yield curve control parameters intact Tuesday. It also updated its price and growth forecasts with no overall change to the picture of an economy heading slowly toward its first rate hike since 2007.

Speaking after the decision, Ueda said any rate increase would initially aim to leave BOJ policy supportive of the economy and would aim to avoid causing too much disturbance. Following up on newly introduced language in the central bank’s quarterly outlook report, the governor said the certainty of achieving the BOJ’s projections has continued to gradually increase.

That language supports the prevailing view among economists that the BOJ will raise rates at some point in the first part of this year, with meetings slated for March, April, June and July. The question is when.

“It’s obvious the BOJ is laying the groundwork for a rate hike with small changes here and there,” said Atsushi Takeda, chief economist at Itochu Research Institute.

“The BOJ will have more information by April, likely increasing their certainty of attaining the target. So the negative rate will probably reach its end in April,” Takeda added, noting that the governor didn’t rule out a March move.

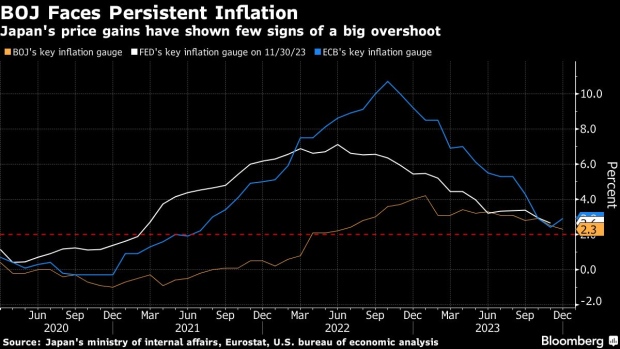

With the hold, the BOJ retains its status as global outlier on central bank policy, as the Federal Reserve and European Central Bank hint at rate cuts later this year. With Ueda stressing the need for a smooth transition, the BOJ may prefer not to wait too long before it heads in the opposite direction so that it can avoid amplifying the likely market ripples that move might cause.

What Bloomberg Economics Says...

“We still think April is less likely than July, though the risks to our call have risen. The good news is Ueda sent a clear message the BOJ will keep policy accommodative even after it moves away from its current framework — in line with our view.”

— Taro Kimura, economist

For the full report, click here.

The market response to the stand-pat decision and Ueda’s remarks suggested investors were having difficulty drawing any clear conclusions on timing. The yen weakened then strengthened against the dollar immediately after the announcement and during the press briefing before giving up some of the gains.

The moves left the yen near the 147.50 mark against the dollar at around 5:30 p.m. local time compared with 148.18 immediately before the decision. The yield on 10-year government debt followed a similar intraday arc, starting off with a fall to 0.630% before giving back some of the falls. Japanese stocks erased their morning rally.

Economists surveyed before the decision saw April as the most liking timing for the end of the negative rate as it will provide time for the central bank to assess the results of annual pay negotiations. Higher raises are seen as a key element for securing a positive cycle of rising prices and wages that feeds into economic growth.

The initial pay results will be available in time for the March meeting, keeping it live as a possibility for the rate move. But the BOJ chief has previously said he wants to see at least some evidence that wages at smaller firms that employ a larger swathe of the population are also rising, a factor that appears to favor a later move.

At the meeting, the central bank cut its inflation forecast for the fiscal year starting in April to 2.4% from 2.8% in a quarterly outlook report due to recent declines in oil prices. That still leaves price gains continuing to exceed the BOJ’s 2% target for some time, as has been the case since April 2022.

All BOJ watchers surveyed by Bloomberg had expected the stand-pat decision. A major earthquake on New Year’s Day and a deepening slush-fund scandal engulfing Prime Minister Fumio Kishida’s ruling party made this an inopportune time for Japan’s first rate hike since 2007.

The swaps market indicated a 56% likelihood of a rate hike by the April meeting and 100% by the June gathering.

Prior to the Tuesday meeting, people familiar with the matter said BOJ officials were of the view that their price projections — around 2% or higher — are already high enough to justify ending the negative rate, and their focus now is on whether the certainty for the outlook will increase sufficiently.

Additional wording in the statement pointed to an improving trend in the gap between supply and demand, a factor that suggests a virtuous cycle of growth is starting to emerge.

“Still, there is uncertainty about April itself. The inflation rate could be backed by wage rises but still there’s a lot of uncertainty about whether 2% is really firmly anchored in Japan’s society,” said Kazuo Momma, a former BOJ executive director in charge of monetary policy, speaking on Bloomberg TV.

“The BOJ will be continuously cautious about raising interest rates going forward. Maybe one or two rate hikes is possible this year, but they are still very uncertain about that,” he added.

If and when the BOJ does end its negative rate regime, it will likely proceed with caution from there.

“Extremely accommodative financial conditions will stay in place for the time being even if the negative rate is ended,” Ueda said at the briefing.

Economists don’t expect to see a tightening cycle of the same magnitude as those at the Fed and the ECB, as Ueda seeks to remain supportive of the economy.

“The BOJ has tried and failed to normalize its policy in the past and it’s always at the back of their mind what will happen if they make a mistake again this time,” said economist Takeshi Minami at Norinchukin Research.

--With assistance from Erica Yokoyama, Yoshiaki Nohara and Brett Miller.

(Adds comments from Ueda’s press briefing)

©2024 Bloomberg L.P.