Oct 4, 2018

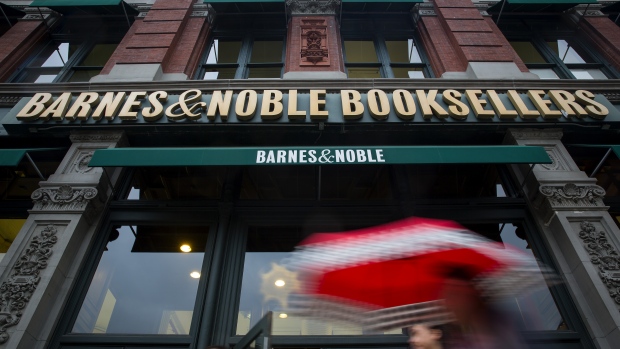

Barnes & Noble soars on hopes going private could mean faster changes

, Bloomberg News

Barnes & Noble Inc., facing management upheaval and shrinking revenue, buoyed shareholders’ spirits with news it’s weighing acquisition interest from several parties, including Chairman Len Riggio.

Shares of the struggling bookseller soared as much as 31 percent in New York Thursday, erasing all of the year-to-date losses. That’s the biggest intraday gain since April 2012.

The company said late Wednesday that it had created a special board committee to consider its strategic alternatives. The book retailer also enacted a takeover defense plan, after observing “rapid material” purchases of its stock by an unidentified investor. The retailer didn’t name the other interested parties.

David Schick, director of research for Consumer Edge Research, said taking the company private could allow more rapid improvements at the book and gift chain, which has posted six years of revenue declines as it tries new formats and strategies to compete with the likes of Amazon.com Inc.

“Not managing to publicly announced quarters could allow more aggressive changes,” Schick said in an email. The company “should and could work to more aggressively update cafe offerings, modernize the membership and improve the digital elements of the omni-channel business.” It could also evolve toward a more “independent bookstore” feel, he said.

Rapid Changes

One of the knocks against Barnes & Noble for years has been that it wasn’t leveraging its assets enough. While many retailers are just now trying to make their locations more experiential, the company already had loads of that with its cafes, reading nooks and play areas for kids. That pushes customers to spend more time in its stores, so there should be a way to get them to spend more.

The company has tried to placate investors’ frustration with its sagging sales by expanding into other categories. Nearly a decade ago, it invested heavily in creating its own e-readers and tablets under the Nook brand to capture the growing market for electronic books. But that endeavor didn’t turn out well, with the company writing off millions in assets. It has since reduced the cost of this division by partnering with electronics-maker Samsung.

Another critique is that the company’s website and other technologies lag far behind competitors like Amazon, which began as a bookseller itself. A mainstay of the retail industry is offering customers the ability to pick up online purchases in a store. Barnes & Noble rolled that out just earlier this year.

There have also been personnel issues. Earlier this year, the company fired former chief executive officer Demos Parneros without severance pay for violating company policies, including alleged sexual harassment -- a claim that Parneros denies, and he’s sued as result. Meanwhile, continued sales erosion has caused the stock to lose almost 19 percent of its value this year through Wednesday’s close.

Riggio, also the company’s founder, largest shareholder and acting chief executive officer, has previously expressed interest in buying, only to back off.

Because of the stock’s declines, market capitalization for the company was short of $400 million ahead of the announcement Wednesday. A one-time mall stalwart, Barnes & Noble’s market cap was about one-tenth the size of shoe brand Skechers U.S.A. Inc. It was back above $500 million during Thursday trading.