Jan 22, 2024

Barstool Deal Boosts Video Site Rumble’s Value by $400 Million

, Bloomberg News

(Bloomberg) -- A partnership with Dave Portnoy’s Barstool Sports is powering shares of video platform Rumble Inc. higher.

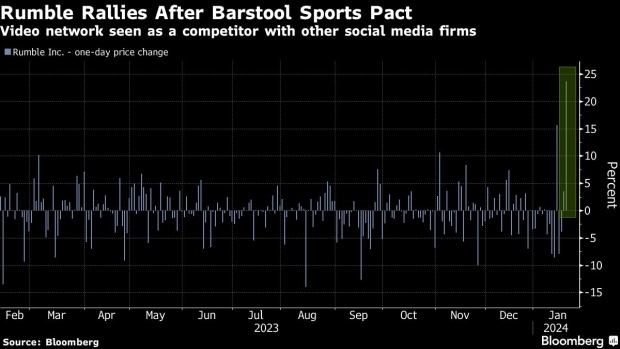

Investors flocked to the company backed by billionaire Peter Thiel, driving shares up 36% — adding about $502 million to its value. It was the biggest intraday share move since the company began trading in September 2022. The pact announced Monday will provide Rumble users access to all of Barstool’s sports and entertainment content on the platform and includes an advertising arrangement.

Nearly 22 million shares changed hands on Monday, almost 12 times the average seen over the past 30 days.

Rumble has emerged as an alternative to Google’s YouTube and aims to compete with social-media firms like X and Facebook. It claims to “create technologies that are immune to cancel culture,” according to the company’s website.

Since going public through a blank-check merger in 2022, Rumble shares have struggled. The stock has fallen about 60% since its debut.

Earlier this month, Barstool’s Chief Executive Officer Erika Ayers Badan stepped down. The departure took place five months after Penn Entertainment Inc., which used the brand to launch an online gambling business, sold Barstool back to Portnoy for $1 last year, taking a loss of up to $850 million.

Barstool has grown its audience by 194% over the past three years and reached 1.6 billion podcast downloads, according to the press release. The new deal will provide it access to Rumble’s cloud services.

(Updates share move and value.)

©2024 Bloomberg L.P.