Dec 12, 2023

Best Bond Forecasters of 2023 Say the Rally Is Doomed to Fizzle

, Bloomberg News

(Bloomberg) -- The most accurate US bond forecasters of 2023 say the strong year-end rally won’t stretch into 2024.

Goldman Sachs Group Inc.’s Praveen Korapaty, the bank’s chief interest-rate strategist, and Joseph Brusuelas, the top economist at tax consulting firm RSM, both predict that the 10-year Treasury yield will climb to about 4.5% by the end of next year. BMO Capital Markets’ Scott Anderson sees it ending 2024 only little changed from where it’s been hovering — around 4.2%.

The three were the only ones among the 40 economists and strategists surveyed by Bloomberg who correctly predicted that the benchmark Treasury rate would rise over 4% to end this year near its current level.

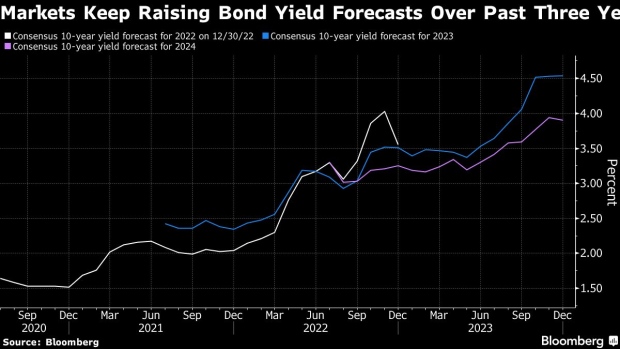

They now say traders are falling into the same trap they did heading into the last two years: underestimating the economy’s strength and the likely persistence of inflation pressures. Signs of a slowdown in both helped drive the US bond market last month to its biggest gain since the mid-1980s, with yields tumbling sharply on speculation the Fed will cut its benchmark rate by over a full percentage point in 2024, starting in the first half of the year.

“Markets are pricing too much policy easing too soon,” said Korapaty.

The calls aren’t particularly worrisome, given that they would mean the debt market would effectively steady after being hammered by losses in 2021, 2022 and most of this year. But they highlight the risk that markets are prematurely dismissing the chance the Fed will keep rates elevated until inflation is safely reined in. The average forecast of those surveyed by Bloomberg is that 10-year yields will slide to 3.9% by the end of 2024.

BMO’s Anderson said the low rates of the pre-pandemic era are unlikely to return soon due to economic shifts that have increased the so-called neutral interest rate, or the level that doesn’t affect the pace of growth. That means policymakers would need to keep rates higher than they once did just to avoid stimulating the economy. The Fed concludes its next meeting Wednesday and may provide insight into where it’s headed.

“Our longer-term forecast on the Fed over the next five years is that the Fed funds rate won’t be moving back down to pre-pandemic levels anytime soon,” he said.

What Bloomberg Strategists say:

Rate markets priced for deep cuts in early 2024 may get a shock if the Federal Reserve reiterates that it will keep interest rates at their peak well into next year. Fed sentiment remains neutral, which we expect to be maintained, as consumer financial conditions aren’t tight. Click here for the full report.

—Ira Jersey, Will Hoffman, Rates Strategists

With inflation remaining above the Fed’s 2% target and few signs of a recession in sight, Goldman Sachs’s economists see a half-point cut by the Fed next year, starting in the third quarter. That’s roughly half as much as the futures market has been pricing in.

While Korapaty isn’t ruling out the risk of an economic contraction, he said there’s a slightly bigger risk that yields may rise above his base-line scenario of 4.55% if inflation prove sticky or the spreading adoption of artificial intelligence leads to a productivity boom.

He said that last year most of his peers were too pessimistic about the economy. They were also blindsided by other factors, like de-globalization and large government spending on green energy, that he said contributed to stickier inflation and higher interest rates globally.

“They failed to forecast this kind of regime shift,” Korapaty said.

RSM’s Brusuelas, along with colleague Tuan Nguyen, were also more accurate than most others this year, predicting that 10-year yields would end 2023 at 4.5%.

Brusuelas sees limited room for bond yields to fall next year because the resilient labor market indicates inflation will likely be slow to pull back to the Fed’s target. A government report on Tuesday showed that while the consumer price index slowed to a 3.1% annual pace in November, the underlying core gauge — which excludes volatile food and energy prices — held at 4%.

Even if consumer price increases continue to slow gradually, a 2.5% inflation rate, plus 2% economic growth, suggest 10-year yields should be around 4.5%, he said.

“I’m not in the recession camp,” said Brusuelas. A structural labor shortage – due to baby-boomer retiring and more stringent immigration — means inflation will “run a bit hot for the next couple of years,” he added.

(Updates to add CPI report in antepenultimate paragraph.)

©2023 Bloomberg L.P.