Dec 14, 2022

Big Europe Funds Say China Stock Swings a Chance to Add Bets

, Bloomberg News

(Bloomberg) -- Chinese stocks are a buy even after a huge reopening rally and any dips are a chance to add positions, according to two of Europe’s biggest asset managers.

“Real money has been put to work,” but Chinese equities are still under-owned, said Nicholas McConway, Amundi SA’s London-based head of Asia ex-Japan equities. “We see more upside to this market from this point into second quarter next year.”

McConway’s comments echo a growing bullish conviction across Wall Street as Beijing ends its Covid Zero policy. While the sudden U-turn has brought huge market swings amid a surge in infections, some investors are willing to stomach the choppy ride on bets that equities will continue their uptrend well into 2023.

Markets should be able to look past the potential health toll as it only poses temporary risks to economic growth, said McConway, who boosted his position in Chinese stocks after Beijing made a major Covid pivot in a 20-measure plan last month.

“Our approach to China would be any pullbacks are pullbacks to be bought,” he said in an interview this week.

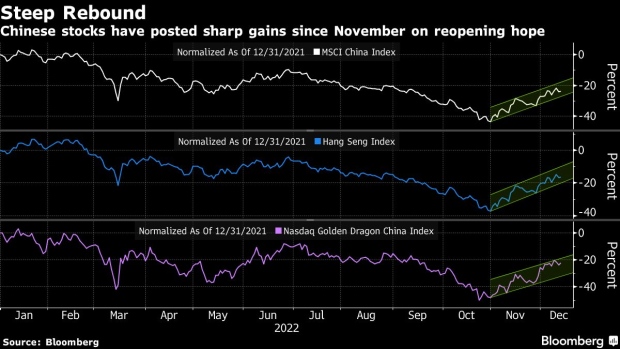

Chinese stocks — once the world’s worst performers — have come to life as Beijing started rolling back draconian Covid restrictions while adding support for the ailing property sector. Since hitting a more-than-decade low on Oct. 31, the MSCI China Index has gained about 36% through Wednesday, handily beating both regional and global peers.

At the same time, few expect the reopening path to be smooth. Chinese stocks are now moving by 5% a day more frequently than any time since the global market meltdown of 2008. Volatility has come down a bit in recent trading, however, with the Hang Seng Index rising 0.4% in Hong Kong and a gauge of Chinese internet stocks in the US gaining 0.5% in Wednesday’s premarket session.

READ: China’s Markets Are Primed for Extreme Volatility in 2023

Elevated Volatility

For Virginie Maisonneuve, elevated volatility presents an opportunity for long-term investors to build portfolios of innovative Chinese firms, such as those in the chip or renewable energy sectors.

“In 2023, for people who are underweight in China, it’s a very good year to use that volatility to add selectively for longer term,” Maisonneuve, global chief investment officer for equities at Allianz Global Investors, said in an interview this week. The size of Chinese markets means investors will want to have exposure, she added.

To be sure, a rocky reopening path won’t be the only source of volatility for a market known for speculative trades and an unfavorable regulatory environment. Despite a recent rally that pushed the Hang Seng China Enterprises Index into a bull market, the gauge remains down 19% for the year.

Heightened geopolitical tension with the US over tech supremacy and a potential delisting of Chinese firms’ American depositary receipts are also sure to keep investors on edge.

But as long as the country keeps moving closer to a full reopening, equities aren’t necessarily going to pull back, according to Jonathan Pines, lead portfolio manager for Asia ex-Japan at Federated Hermes Ltd. in London.

The market is short-circuiting the bumpy reopening process and “just focusing on the end result,” Pines said. “This volatility will continue, but we think the direction is up.”

--With assistance from Michael Msika.

(Adds details of Wednesday’s trading in seventh paragraph.)

©2022 Bloomberg L.P.