May 30, 2022

Billionaire’s AGL Win Jolts Australia Awake to Climate Activism

, Bloomberg News

(Bloomberg) -- An Australian billionaire’s success in forcing AGL Ltd. to scrap a breakup plan and its top executives to step down may shake the status quo between shareholders and companies in the region, particularly on climate issues.

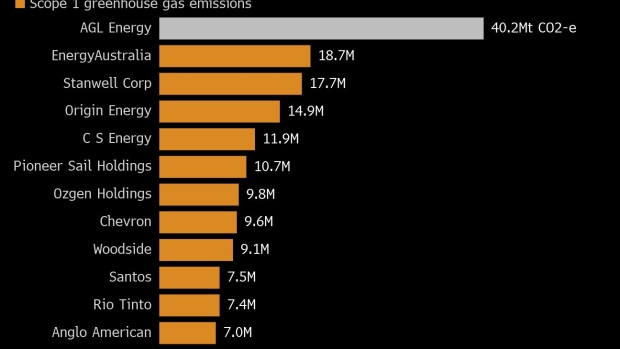

Atlassian Corp. founder Mike Cannon-Brookes halted demerger plans by AGL -- Australia’s biggest producer of scope one greenhouse gases -- that would have allowed it to run coal-fired power plants for another two decades. In doing so, he joined a growing number of activist shareholders including Exxon Mobil Corp. investor Engine No. 1 to have successfully fought big polluters using agitator tactics.

“Australia has never really taken to shareholder activism like other countries,” Gabriel Radzyminski, Managing Director and Portfolio Manager of Sandon Capital, one of the region’s few public activist funds, said on Monday. “Part of the problem here is the business and investment community is very small, which means the people all know each other within three or quite possibly two degrees of separation.”

READ: Billionaire’s Climate Activism Forces Australian Polluter U-Turn

Major investors, including stewards of Australia’s A$3 trillion ($2.15 trillion) superannuation industry, will be watching the AGL developments closely. Many see themselves as soft activists because they lobby boards to take action behind closed doors, Radzyminski said.

“What Cannon-Brookes has shown is it takes a willingness to not only carry a stick, but use it,” he said. “Real change only happens when you take a company by the scruff of the neck.”

©2022 Bloomberg L.P.