May 30, 2023

Binance Explores Letting Some Traders Keep Collateral at a Bank

, Bloomberg News

(Bloomberg) -- Binance is discussing a proposal to let some of its institutional clients keep their trading collateral at a bank instead of with the crypto platform, a step that could help reduce counterparty risk.

The world’s largest crypto exchange has spoken to some of its professional customers about a setup that would allow them to use bank deposits as collateral for margin trading in spot and derivatives, according to four people familiar with the matter.

Swiss-based FlowBank and Liechtenstein-based Bank Frick have been mentioned as potential intermediaries for the service, said two of the people, who asked not to be identified as the deliberations are private.

Institutional digital-asset traders have been agitating for change after FTX’s abrupt collapse late last year left many with large losses. Crypto exchanges operate differently than traditional finance in that they not only facilitate trading, but also keep assets in custody, settle transactions and offer credit — increasing the risk of widespread pain should they fail.

Read more: FTX-Trapped Crypto Hedge Funds Want Wall Street-Style Middlemen

A spokesperson at Binance declined to comment. Bank Frick also declined to comment, citing banking secrecy laws. FlowBank said its license doesn’t include crypto trading, without commenting on any arrangements with Binance. The proposed setup hasn’t been finalized and could change, the people said.

Under one version of the proposal Binance has discussed, clients’ cash at the bank would be locked up through a tri-party agreement while the exchange lends them stablecoins to serve as collateral for margin trading, the people said. The cash kept with the bank could then be invested in money-market funds to earn interest, helping to compensate for the cost of borrowing crypto from Binance, they said.

Binance’s discussions come as centralized cryptocurrency exchanges face growing pressure from clients seeking ways to guarantee they’d be insulated from a potential failure. Safe custody and segregation of client assets have also been the focus of Asian and European regulatory proposals, while Nasdaq Inc., Bank of New York Mellon Corp. and Fidelity Investments are offering or building crypto custody solutions for institutions.

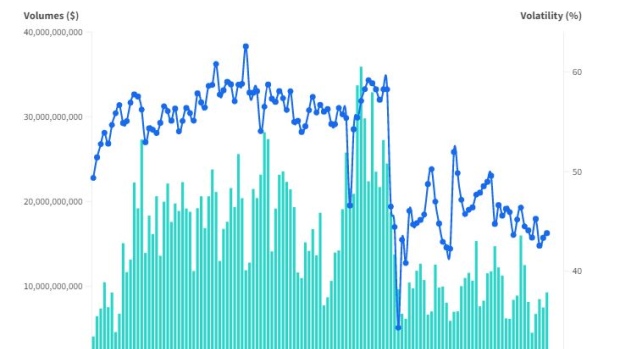

Binance’s market share has shrunk since it ended a zero-fee promotion in March and as the Commodity Futures Trading Commission’s lawsuit against it unnerved some traders. Its portion of spot volume dropped from a February peak of about 63% to 44% in early May, while for derivatives it fell from 77% in March to 66% as of last week, according to CCData.

Middlemen are slowly becoming more common in the crypto industry. Copper, a custodian, announced in April that its Clearloop service for off-exchange settlements will be integrated on OKX, one of the largest exchanges.

After FTX went under, Binance also started offering a custody solution called Ceffu that allows institutional clients to keep their assets in a segregated cold wallet. A 2022 corporate filing showed that the company which runs Ceffu was wholly owned by Binance Chief Executive Officer Changpeng Zhao.

©2023 Bloomberg L.P.