Dec 27, 2023

Bitcoin Advances as Optimism Builds About ETF Approval by SEC

, Bloomberg News

(Bloomberg) -- Bitcoin recovered amid renewed speculation that the US securities regulator is getting close to approving an exchange-traded fund investing directly in the biggest token.

Bitcoin advanced as much as 2.1% and traded around $43,000 as of 12:10 p.m. in London, rebounding from Tuesday’s drop. Other major cryptocurrencies also gained. Bitcoin Cash, one of the early offshoots of the original digital currency, rallied as much as 14% after investors piled into an investment vehicle tracking the token.

Grayscale Investments said Tuesday that Barry Silbert, who is also founder and chief executive officer of its parent company Digital Currency Group, has resigned as chairman and will be succeeded by Mark Shifke.

The move comes ahead of a Jan. 10 deadline for the US Securities and Exchange Commission to decide whether to give its first blessing for a spot Bitcoin ETF. Grayscale is seeking approval for converting its Bitcoin trust, the world’s biggest, into an ETF.

Read more: Grayscale Chair Silbert Resigns While SEC Mulls Bitcoin ETF

“Silbert’s stepping down is seen as an overall positive sentiment for demand for Bitcoin,” said Hayden Hughes, co-founder of social-trading platform Alpha Impact. “There are also expectations building that after Silbert’s resignation, the SEC might allow other Grayscale products to be listed as ETFs, which is driving institutional demand in Grayscale Bitcoin Cash Trust.”

The Grayscale Bitcoin Cash Trust soared 18% on Tuesday in trading volume that was more than seven times the six-month daily average, data compiled by Bloomberg show. Grayscale didn’t immediately respond to an emailed request for comment.

One key issue is whether an actual nod for the products will spur some profit-taking, based on the adage that investors “buy the rumor and sell the news.” Put another way, the potential interest in the spot Bitcoin ETFs planned by the likes of BlackRock Inc. and Fidelity Investments remains unclear.

Read more: Bitcoin’s Rebound in 2023 Is a Gamble on ETF ‘Demand Shock’

The market is “almost certain” that the SEC will give permission for spot Bitcoin ETFs before Jan. 10, Nic Carter, founding partner at Castle Island Management LLC, said on Bloomberg Television. The funds will widen the base of crypto investors in the medium term, he said, while flagging the possibility of a “news selling event” in the more immediate period.

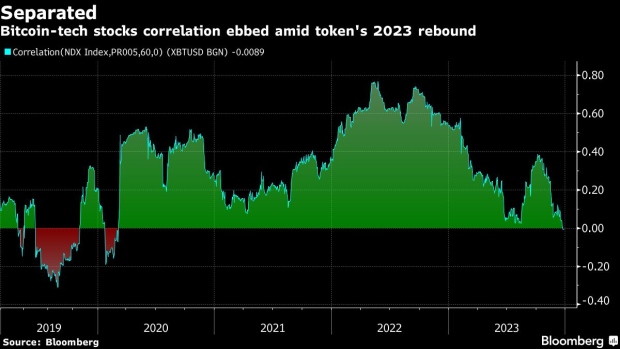

Bitcoin’s advance this year has also been fueled by expectations of declining interest rates in the US. The rally has partially repaired the damage from a precipitous 2022 crash that reverberated around the crypto industry. The token remains below its 2021 pandemic-era record of almost $69,000.

©2023 Bloomberg L.P.