Mar 8, 2024

Bitcoin-at-$100,000 Forecasts Are Looking More Realistic in the Options Market

, Bloomberg News

(Bloomberg) -- After long being scoffed at as just more hype from crypto evangelists, Bitcoin-at-$100,000 predictions are beginning to look like a realistic possibility in the options market.

The largest cryptocurrency jumped to another all-time high of more than $70,000 on Friday, capping a seven-week run of more than 70%.

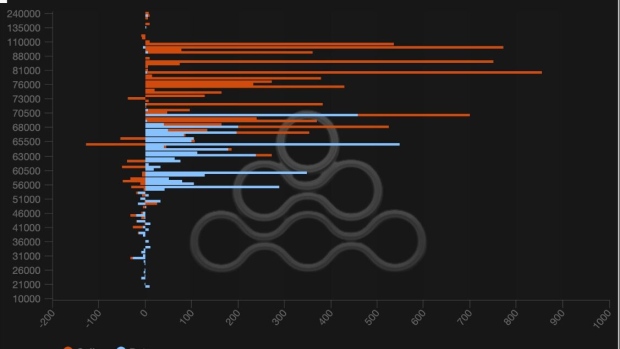

In the options market, the open interest, or the number of outstanding contracts, for call options with strike prices of $80,000 and $100,000 has jumped around 12% each in the last 24 hours, according to data compiled by Amberdata.

“I think $80K by end of month is not crazy,” said Leo Mizuhara, founder and chief executive of decentralized-finance institutional asset management platform Hashnote. “I just think the FOMO players are coming in soon. ETFs have opened up the space to even more retail.”

The latest shifts in positioning raises the possibility of a more sustained rally than during the runup on Tuesday, when the digital asset breached its previous record high set in late 2021. Lower volatility and leverage, as seen in the options and futures markets, suggest that Friday’s price move was more driven by demand from the spot market. Retail investors tend buy tokens in the cash market rather than using derivatives that help bolster leverage.

The current increase in Bitcoin’s price appears to be more spot-driven since the market is much “healthier,” with lower leverage compared to Tuesday, said Luke Nolan, research associate at crypto asset manager CoinShares.

The annualized funding rate for Bitcoin perpetual futures on Binance, which is a key indicator for leverage in crypto trading, was around 57% as of 1: 30 p.m. in New York. The funding rate climbed to more than 100% on Tuesday. Implied volatility for Bitcoin options dropped significantly when the price tumbled Tuesday immediately after the old high was breached.

To be clear, bullish sentiment and speculation continue to keep leverage elevated. The pullback after Bitcoin hit $70,000 on Friday has been in part due to liquidations across the derivatives market.

“Open interest is still sky high and there’s still rampant speculation,” said Zaheer Ebtikar, founder of crypto fund Split Capital. “This is generally the hardest part of the crypto cycle as hotter money comes in and pushes valuations the furthest but at the same time increases risk and volatility.”

Optimism over record inflow into newly launched spot Bitcoin exchange-traded funds has been the main driving force behind the bull run. The nine new ETFs have seen around $10 billion in net inflows since they began trading Jan. 11.

“We are seeing some of the strongest flows,” Nolan said.

--With assistance from Muyao Shen.

©2024 Bloomberg L.P.