Jul 8, 2022

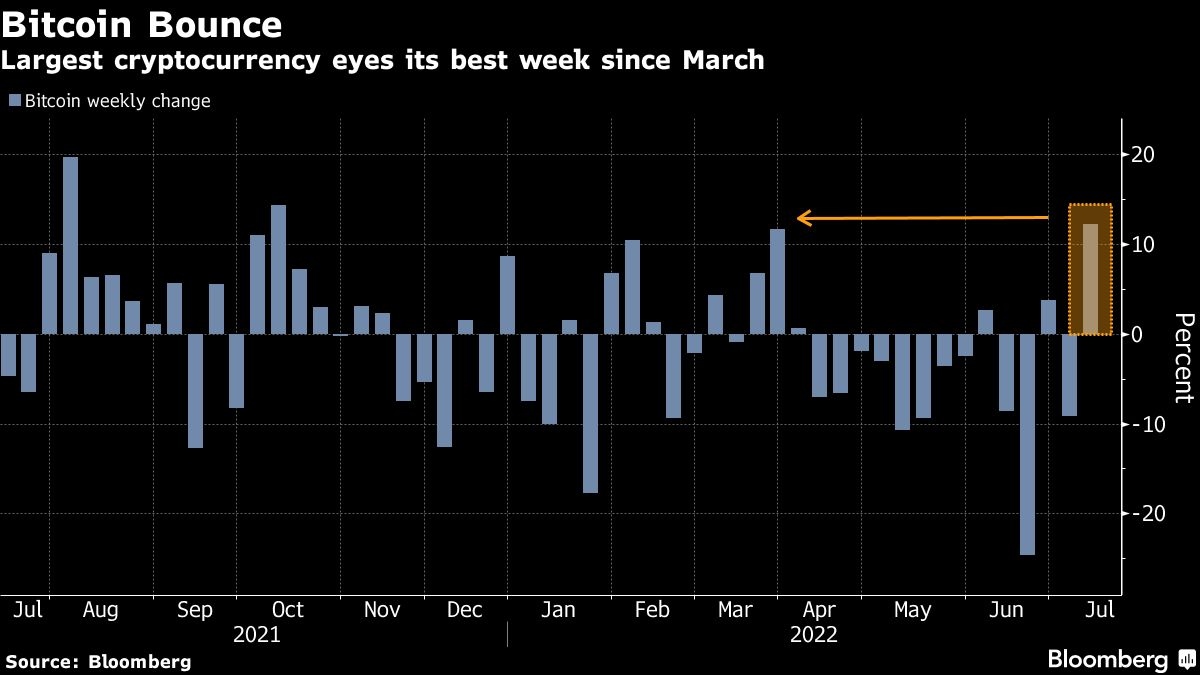

Bitcoin is on course for its biggest weekly gain since March

, Bloomberg News

Some crypto traders turning against each other

Bitcoin is on course for its best weekly gain since March, helped by a return of risk appetite in global markets more broadly.

The largest cryptocurrency by market capitalization was up more than 10% for the week so far as of 10:18 a.m. New York time on Friday. It gave up some gains after briefly trading above US$22,000, in step with the slump in US equities. The coin is now trading flat at about US$21,700.

The S&P 500 and the Nasdaq 100 fell for the first time in five days after the US jobs report showed that employment growth cooled slightly but remained strong, clearing the path for the Federal Reserve to remain aggressive in its fight against inflation. Treasury yields spiked and the two- and 10-year yield curve remained inverted for the fourth day.

“Right now, Bitcoin and most other assets are very much beholden to broader forces imposed on us all by a tough macro environment and a hawkish Federal Reserve,” said Garry Krugljakow, founder of GOGO Protocol, an open-source DeFi protocol for asset management and savings. “There’s too much uncertainty. I will say, however, that Bitcoin has held up rather well in comparison to a lot of other assets. And looking back on this bear market, people will likely remember it as Bitcoin showing its true strength to the world.”

Fed officials have pivoted policy aggressively to confront the hottest inflation in 40 years by raising interest rates by 75 basis points last month, the biggest such move since 1994. And based on the jobs data Friday, some, including Atlanta Fed President Raphael Bostic, believe the committee can move 75 basis points in the next meeting without damaging the economy.

“The only Bitcoin bottom signal for me is persistent data showing us that inflation is convincingly inflecting down,” Marcus Sotiriou, analyst at GlobalBlock, said. “This should result in the Federal Reserve becoming less aggressive with their monetary policy, and therefore provide confidence that the liquidity crisis in the crypto market is over.”

Bitcoin has tumbled 60 per cent year-to-date as hawkish central banks and a string of high-profile crypto blowups hammered sentiment. Companies whose performance are closely linked to the coin have also taken a beating, prompting a growing list of crypto firms, lenders and hedge funds maimed by the downturn to execute massive layoffs, freeze withdrawals or suspend trading.

“Risk markets are up across the board” and thus “it’s not surprising that crypto is trading higher,” said Ben McMillan, chief investment officer at IDX Digital Assets. “After a cascade of bad news and large liquidations, many crypto investors are still sitting on the sidelines waiting for the next shoe to drop.”

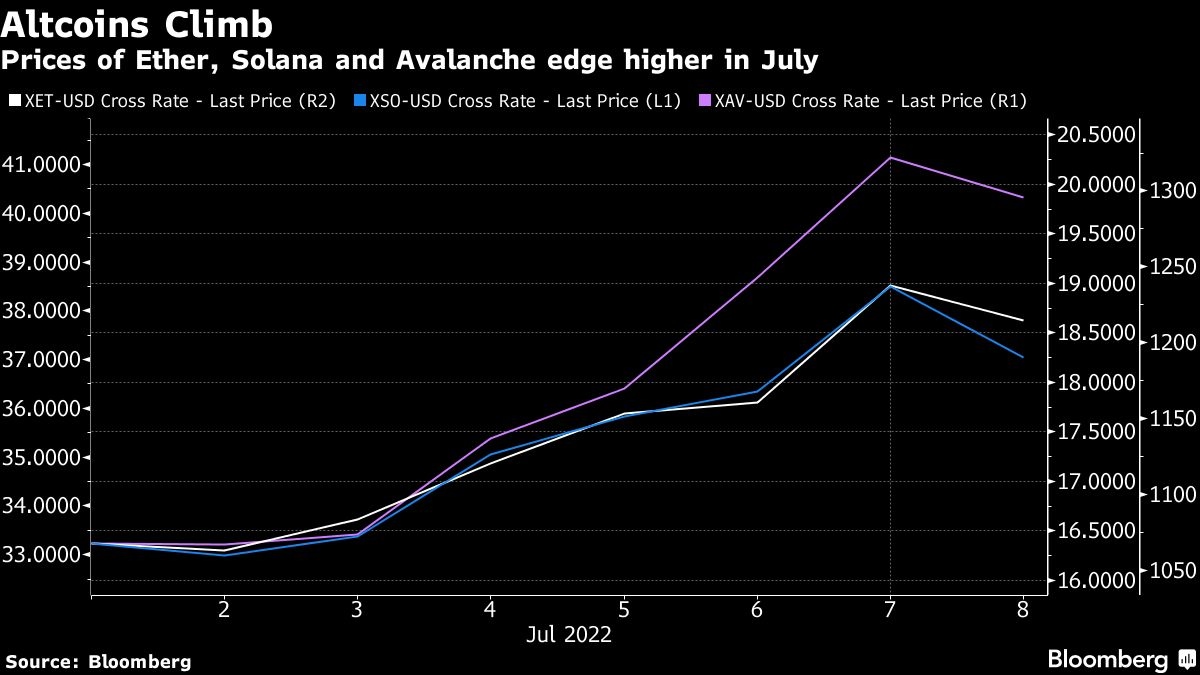

Other tokens like Ether, Avalanche and Solana have also had a strong run in recent days, helping to take the overall market value of cryptocurrencies back close to US$1 trillion, a 1.4 per cent rise in the last 24 hours, according to CoinGecko data.

Still, regulators seem to be concerned of contagion risks brought about by digital assets. Fed Vice Chair Lael Brainard on Friday said even if the recent turmoil in the crypto market does not yet pose a “systemic risk” to the broader financial system, authorities need to close regulatory gaps to protect consumers and ensure stability.