Aug 8, 2022

Bitcoin Leads Crypto Rally as Market Shrugs Off US Jobs Shock

, Bloomberg News

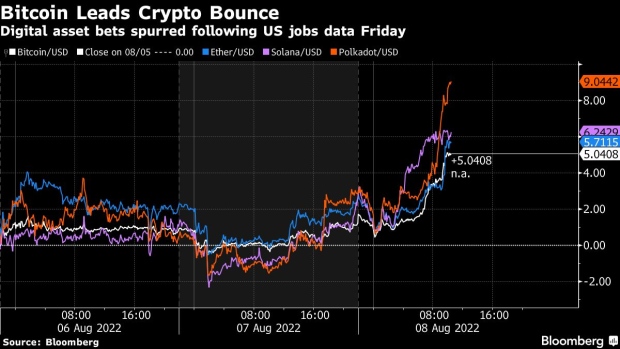

(Bloomberg) -- Bitcoin spearheaded a rally in crypto tokens Monday as investors turned to digital assets in the wake of robust US jobs data.

The largest cryptocurrency by market value rose as much as 4% above the $24,000 mark by mid-morning trading in London, while Ether was up 3% at around $1,770. The sector was buoyed alongside similar moves in European stocks and US equity futures after the strong payrolls print suggested the world’s biggest economy may avoid a hard landing even as the Federal Reserve tightens aggressively.

Altcoins added to the sea of green, Bloomberg pricing data showed, with Solana’s SOL, Polkadot’s DOT and Avalanche’s AVAX all gaining more than 3% in the past 24 hours.

“Sentiment across the markets looks a little fragile this morning and yet crypto appears to have shrugged off Friday’s shock much more quickly,” said Craig Erlam, senior markets analyst at Oanda, in notel to clients.

Bitcoin has its “sights set on $25,000 it seems”, he said, following its rally last week after a few difficult months of trading. “The momentum indicators will be fascinating here as the recovery appeared to be losing steam during the last ascent in late July.”

A prolonged bear market for cryptoassets has seen Bitcoin lose more than 47% of its value so far this year, and it remains roughly 65% below the all-time high of $68,991 that it achieved in November last year. Knocked by a spate of company bankruptcies and the failure of major decentralized finance project Terra in May, the crypto market has struggled to meaningfully recover ground in a series of miniature rallies this summer.

Despite crypto’s pitch to investors as a useful hedge against inflation, the prices of Bitcoin and other cryptocurrencies have become increasingly affected by traditional market drivers like monetary policy. Bitcoin maintains a strong relationship with indexes like the S&P 500 and the Nasdaq 100, with a correlation above 0.6 on Monday. A level of 1 would mean the two are trading in lock step, while 0 would mean they are not linked at all.

“With another 75 basis-point rate hike next month now the favoured outcome, although a lot can change in that time, it could be a nervy couple of days for investors ahead of Wednesday’s inflation report,” Erlam said.

©2022 Bloomberg L.P.