Aug 22, 2022

Bitcoin Nurses Losses as Momentum Gauge Flashes Price Warning

, Bloomberg News

(Bloomberg) -- Bitcoin nursed a four-day drop of about 9%, held back by a bout of risk aversion in global markets on jitters over tightening Federal Reserve monetary policy.

The largest crypto fell as much as 2.7% to $20,906 on Monday, though was back around $21,300 as of 10:08 a.m. New York time. Ether slipped also, and smaller tokens like Avalanche and Cardano lost more than 5%.

Faith in the global equity rebound from June’s bear-market lows is starting to crack in part because of the Fed’s commitment to raising interest rates further and drain liquidity. US and European equities retreated on Monday, keeping the pressure on crypto given the correlation between the two asset classes.

“Bitcoin’s fortunes, at least in the short to medium term, continue to be hitched to the wagon of other long-duration growth assets such as technology stocks,” Jamie Douglas Coutts, senior market structure analyst at Bloomberg Intelligence, wrote in a note.

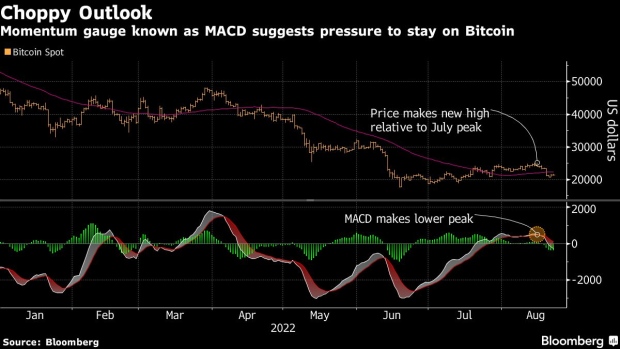

An indicator known as the moving average convergence divergence -- MACD -- also flashed a warning sign. The MACD has turned negative, which for some technical analysts is a sign Bitcoin may continue to come under pressure. The decline of the past few days has also taken Bitcoin and the MVIS CryptoCompare Digital Assets 100 Index below their 50-day moving averages.

Another headwind for Bitcoin may lie with the US dollar, a gauge of which rose to the highest level in more than a month.

“In Bitcoin’s short existence, it has had a relatively strong inverse relationship with the DXY” dollar index, said Sean Farrell, a digital-asset strategist at Fundstrat. “It has generally served as beta on risk assets.”

©2022 Bloomberg L.P.