Mar 9, 2022

Bitcoin jumps as much as 11% as U.S. lays groundwork on rules

, Bloomberg News

Crypto players are optimistic the U.S. is creating framework that doesn’t choke innovation: Ledn

Bitcoin jumped above US$42,000 amid a sharp rally in digital tokens, spurred by optimism about a U.S. overhaul of crypto oversight that Treasury Secretary Janet Yellen called “historic.”

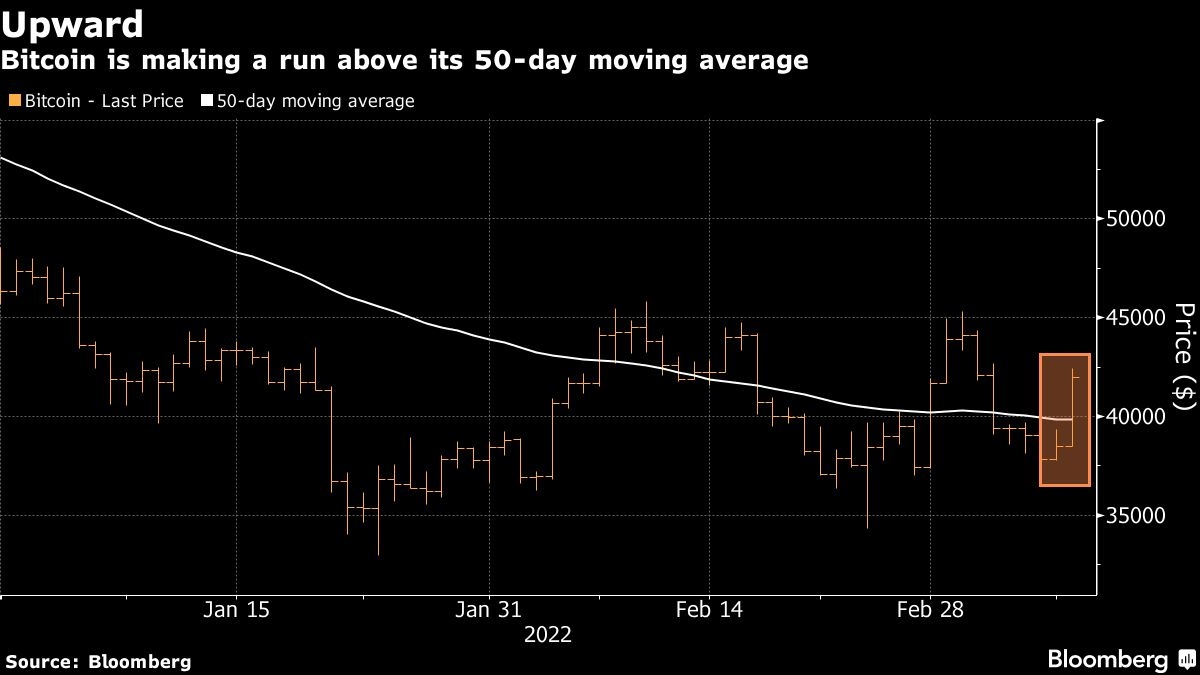

The largest cryptocurrency rose as much as 11 per cent to US$42,581 on Wednesday, its highest level since March 4. Ether climbed 8 per cent while so-called privacy coins like Monero posted large gains. The crypto advance came as a broad risk-on rally lifted U.S. and European stocks.

President Joe Biden’s executive order mandates government agencies to take a closer look at issues from developing a potential digital U.S. dollar to combating illicit finance.

Under the plan, federal agencies from Treasury to the Commerce Department will have to research a number of topics, including the pros and cons of the government launching a U.S. digital currency. The directive also calls for studies and policy recommendations on issues ranging from protecting consumers to climate change.

“Today’s executive order makes it clear: this isn’t them-against-us,” Nathan McCauley, co-founder and chief executive officer at Anchorage Digital, said in a statement. “The administration has made it clear that the United States has the opportunity to lead the world in digital asset development, while also establishing new protections for individual consumers and society as a whole.”

Yellen praised the order in a statement on the Treasury’s website on Tuesday that was later removed, saying it strikes the right balance between fostering innovation and addressing potential risks. That boosted sentiment in an industry that has long called for greater regulatory direction.

“For years, the crypto market has been hindered by a lack of regulatory clarity in the U.S.,” said Hayden Hughes, chief executive officer of trading social-media platform Alpha Impact, in a message Wednesday. “If clear guidelines are passed, this could be a watershed moment for the industry.”

The studies mandated by the order include one led by Treasury on the future of money and payment systems, and another from the Justice Department on the role of law enforcement agencies in detecting, investigating, and prosecuting crypto-related criminal activity. It also calls for regulators to help outline risks tokens could pose to financial stability and offer suggestions for new rules or legislative changes. Officials will also have to develop a framework for engaging with international partners on setting standards for digital assets.

Agencies will have between 90 days and one year to complete their studies, depending on the issue, according to the executive order. Once the reports are finished, the administration has said it plans to move quickly to carry out the recommendations.

Even after Wednesday’s rally, Bitcoin remains within the range of US$33,000 to US$48,000 where it’s traded most of this year. After diverging from stocks early last week, cryptocurrencies gave up most of those gains as the war in Ukraine escalated, pouring cold water on the argument that they’re a safe haven in times of geopolitical turmoil.

“The order seems relatively benign, hence giving the market some clarity,” said Marcus Sotiriou, analyst at digital asset broker GlobalBlock, in a note on Wednesday. “As many investors had prepared for the downside risks of this event by waiting on the sidelines, we are seeing many buy Bitcoin back in what appears to be a spot-driven rally.”

PRIVACY UPSIDE

Privacy coins -- so called for the higher degree of anonymity they afford users -- were some of the biggest winners over the past 24 hours, with Monero jumping 21 per cent and Zcash up 17 per cent, based on CoinGecko data. The gains were driven by speculation that they may get payment traffic displaced by the sanctions on Russia.

“The recent surge in privacy coins is mostly driven by traders speculating on the possibility that we will see capital flight” into them, said Ben Caselin, head of research and strategy at crypto exchange AAX, in a message Wednesday.

While privacy coins allow for a higher degree of anonymity, the networks they live on are less decentralized and less secure than Bitcoin, and limited in market cap, he said. “Rather than a new trend, current uptake is likely to be limited, with more volatility ahead.”