Mar 6, 2024

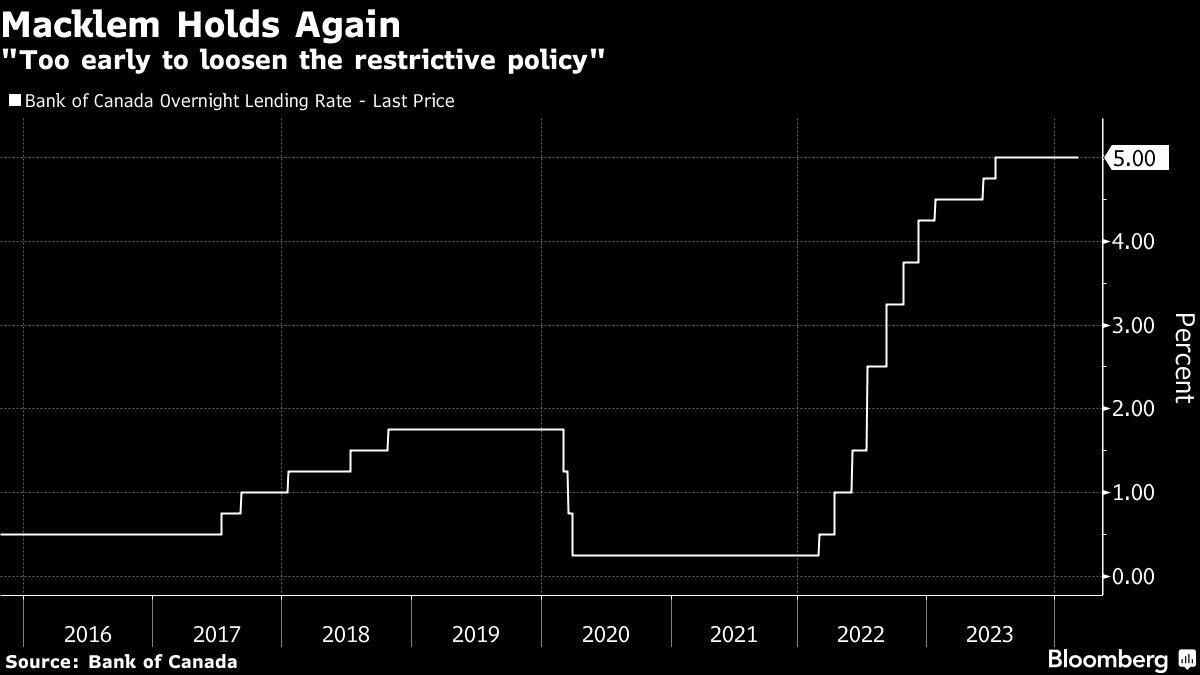

Bank of Canada holds key rate at 5%, says too early to talk cuts

, Bloomberg News

BoC is late on rate cuts and it's concerning: Jim Thorne

The Bank of Canada held its policy rate steady for a fifth consecutive meeting, acknowledging progress on inflation while reiterating that it’s still “too early” to consider rate cuts.

Policymakers led by Governor Tiff Macklem left the benchmark overnight rate unchanged at five per cent on Wednesday. The pause was expected by markets and by economists in a Bloomberg survey.

Officials say there have been “no big surprises” in economic data in the six weeks since their January decision, when they explicitly said they’d shifted their discussions to how long borrowing costs need to stay elevated.

“Today’s decision reflects governing council’s assessment that a policy rate of five per cent remains appropriate. It’s still too early to consider lowering the policy interest rate,” Macklem told reporters.

After Wednesday’s decision, traders in overnight swaps pared their bets on a June rate cut. A cut is still fully priced in for the July decision, just as it was before the policy statement.

Economists see June as the more likely start to the easing cycle.

The bank left the last paragraph of its statement intact with no material changes, keeping the line: “The council is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation.”

The neutral communications suggest policymakers aren’t yet convinced inflation is on a sustained path to their two per cent target, and still want to see clearer progress on price pressures before they’ll start talking about cutting interest rates from restrictive levels.

Dawn Desjardins, chief economist at Deloitte Canada, said the central bank is pushing back against expectations that cuts are imminent. “I think they really want people to be aware that, yes, they’re going to come, but we need to see a true path to two per cent,” she said on BNN Bloomberg Television.

“Recent inflation data suggest monetary policy is working largely as expected. But future progress on inflation is expected to be gradual and uneven, and upside risks to inflation remain,” Macklem said.

‘Excess Supply’

Still, officials say they’re seeing “some signs” that wage pressures are easing and noted that employment gains are lagging population growth. And while the economy grew by more than expected at the end of last year, the bank called the pace of growth “weak and below potential.”

“Overall the data point to an economy in modest excess supply.”

Asked by reporters whether the bank would eventually signal when it plans to start cutting rates, Macklem said officials were wary of giving a sense of “false precision” when it comes to timing, saying “we can’t put it on a calendar.”

“We don’t give forward guidance on our forward guidance,” Macklem said.

The bank’s next rate decision is on April 10, when policymakers will also update their economic projections after getting new information on corporate pricing behavior and inflation expectations — indicators officials say they’re tracking closely.

“The BOC has the luxury to wait until it sees more progress on inflation before starting to ease its policy rate,” said Dominique Lapointe, director of macro strategy for Manulife Investment Management. The economy may continue to weaken in the first half of the year, and “if that happens, the BOC would be in a position to signal a shift towards easing at the April meeting, preparing markets for a June cut.”

The yearly change in the consumer price index decelerated to 2.9 per cent to start the year, just the second time in 34 months that price pressures have fallen below the three per cent cap of the bank’s target band.

In the statement, the bank reiterated that elevated shelter prices are the biggest contributor to inflation, and noted that yearly and three-month measures of core price pressures are stuck in the three per cent to 3.5 per cent range.

In Wednesday’s press conference, Macklem said the so-called trim and median core inflation measures are key to the bank’s thinking, but added that they’re tracking other price indicators, and are “trying to make sure people don’t get fixated on one number.”

Macklem said the bank’s quantitative tightening program is not a root cause of recent pressures in overnight funding markets. Those pressures were not a sign the bank will need to stop shrinking its balance sheet earlier than planned, he added.