Feb 9, 2023

BOE Warns UK Public Sector Pay Raises May Spur Further Inflation

, Bloomberg News

(Bloomberg) -- Bank of England Governor Andrew Bailey warned that big increases in public sector pay would add to inflation unless they were offset by tax increases.

The comments in testimony to Parliament complicated Prime Minister Rishi Sunak’s effort to defuse the the worst strikes since the 1970s. Nurses, teachers and ambulance drivers are among the workers who have walked off the job in recent weeks seeking bigger wage increases to compensate for soaring prices.

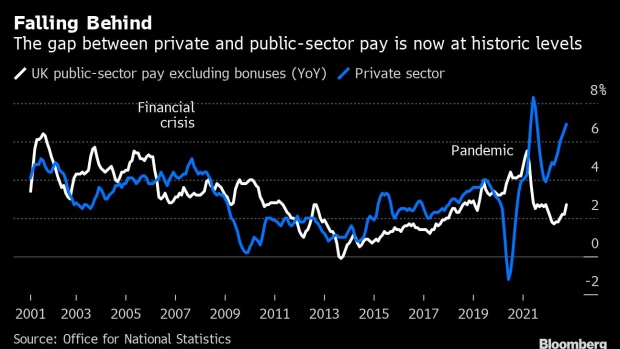

Bailey acknowledged that a “wedge” has opened up between public and private sector pay but warned that the central bank would have to tighten monetary policy more if pay settlements were financed by higher government borrowing.

“The economics of it depends on whether you raise taxes or whether you borrow,” he told lawmakers on the Treasury Committee on Thursday. If the government borrowed to top up pay, it would affect “overall demand in the economy.”

The Trades Union Congress bridled at Bailey’s comment, saying it’s wrong for the governor to call for workers to take a hit on pay when prices are soaring and big energy companies led by BP Plc and Shell Plc are reporting record profits.

“We need restraint on corporate profiteering – not paramedics’ and teachers’ pay,” said TUC General Secretary Paul Nowak. “The last thing working people need right now – in the middle of the worst living standards crisis in generations – is to have their pay held down.”

With inflation lingering near a 41 year high and five times the BOE’s 2% target, the central bank has lifted borrowing costs 10 times to the highest level since 2008. While workers are upset a cost-of-living crisis has drained their spending power, Bailey wants to head off the risk of a wage-price spiral that would exacerbate the inflation problem.

Sunak has promised to cut inflation in half this year and so far is holding off on offering inflation-busting pay increases. But the strikes are set to continue and have contributed to concerns about the outlook for the economy.

Workers with jobs tied to the government including railways and the National Health Service are especially upset. Private sector pay rose 7.2% on average in the year to November, while Britain’s 5.5 million public service workers got an increase of 5% on average. They are demanding deals closer to inflation, which is above 10%.

Every percentage point increase in public sector wages costs around £2.5 billion. Government officials have in the past argued that big pay rises would be inflationary, but Bailey said it would depend on how they are funded.

“There would be a fiscal impact – it would effectively cause stimulation through fiscal effects and we would have to take that into account,” Bailey said.

BOE Chief Economist Huw Pill noted that borrowing for higher wages would lead to interest rate hikes.

A debt-funded pay deal “implies monetary policy will be tighter to keep aggregate behavior in the economy in line with price stability,” Pill said at the same hearing.

The BOE’s key rate has risen from 0.1% to 4% in the past 14 months, squeezing already cash-strapped households and businesses.

In separate comments to MPs, Bailey suggested that unemployment may not need to increase by the forecast 500,000 for inflation to come back to the bank’s 2% target. A loosening of the labor market could come through lower working hours and vacancies rather than swathes of job losses.

The governor said there are “early signs” of the jobs market cooling but that businesses are hesitant about laying off workers after struggling to hire in recent years.

The BOE views an easing in the tight labor market as vital in helping to bring down double-digit inflation. However, Bailey said firms are “more thinking in terms of reducing hours rather than heads.”

“The reason for that and firms say this to me quite consistently is that it is so hard to recruit people in the current environment and has been that they will be reluctant to shed people,” he said.

He added that inflation seems to be headed down.

“I do think we’ve turned the corner in terms of headline inflation,” Bailey said. “It has not only fallen, it’s now under what we thought it would be in November. But we need to see more evidence that this this process will take effect.”

Earlier this month, the BOE forecast that the UK is now in a shallow five quarter recession. Pill said whether the economy shrinks or not, it will “bobbing around the zero level” this year and faces a prolonged period of sluggish growth.

Read more:

- BOE Latest: Bailey Says QT Asset Sales Aren’t Disturbing Markets

- UK Experiencing Largest Loss of Purchasing Power Since Mid-1970s

- BOE Signals Worst Years for UK Growth Since Great Depression

(Updates with comment from TUC from fifth paragraph.)

©2023 Bloomberg L.P.