Nov 2, 2022

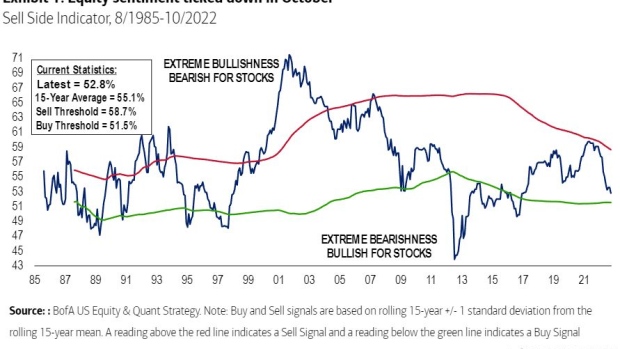

BofA Indicator Is Closest to Saying ‘Buy’ US Stocks Since 2017

, Bloomberg News

(Bloomberg) -- A key indicator of US stocks is close to flashing a “buy” signal, supporting bulls who have pushed equities higher in the run-up to Wednesday’s Federal Reserve meeting.

Bank of America Corp.’s so-called Sell Side Indicator -- a measure of Wall Street sentiment on stocks -- is at its lowest level since 2017. Such levels typically trigger rallies, with 12-month returns for the benchmark S&P 500 Index positive for 94% of the time, strategists including Savita Subramanian wrote in a note dated Nov. 1. The median gain in such scenarios is 22%.

“Wall Street’s consensus equity allocation has been a reliable contrarian indicator over time,” the strategists added.

The equity-sentiment measure is one of the inputs that has gone into setting BofA’s S&P 500 target at 3,600 for this year and signals the equity gauge can rise to 4,500 over the next 12 months, they wrote. The stocks benchmark closed at 3,856.10 on Tuesday.

Expectations of a dovish turn in Fed’s policy have grown stronger ahead of a rate decision scheduled later today. The optimism has helped the S&P 500 Index rebound more than 10% since a mid-October low, when it fell to November 2020 levels.

Meanwhile, the average recommended stock allocation among Wall Street analysts has dropped by more than 6 percentage points this year, and the proposed proportion for bonds has increased by about 5 percentage points, BofA’s Subramanian and team said.

(Updates lead, adds background)

©2022 Bloomberg L.P.