Mar 24, 2023

BofA’s Hartnett Sees ‘Greedy’ Stocks Falling as Cash Levels Soar

, Bloomberg News

(Bloomberg) -- Investors are fleeing to cash in the biggest rush since the onset of the pandemic as concerns of an economic slowdown mount, according to Bank of America Corp. strategists who see equity and credit markets slumping in coming months.

“Credit and stock markets too greedy for rate cuts, not fearful enough of recession,” a team led by Michael Hartnett wrote in a note on dated Thursday. The strategist, who was correctly bearish through last year, said investment-grade spreads and stocks will be taking a hit over the next three to six months.

Markets have been on edge amid the collapse of several US lenders and turmoil at Credit Suisse Group AG which led to its government-brokered takeover by UBS Group AG. That hasn’t swayed central banks, with the Federal Reserve, European Central Bank and Bank of England among those that have pressed on with hiking rates to tame inflation even in the face of banking system stress.

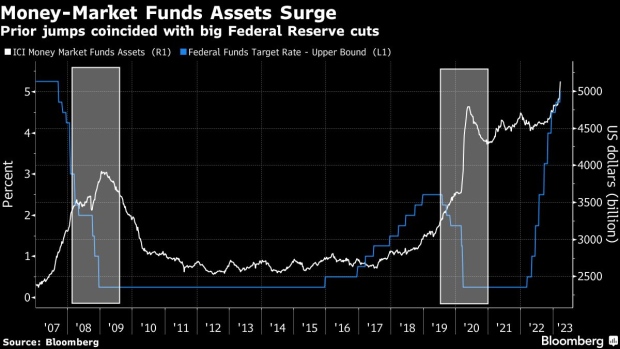

Global cash funds had inflows of nearly $143 billion, the largest since March 2020 in the week through Wednesday — adding up to more than $300 billion over the past four weeks, according to the note citing EPFR Global data. Money market funds assets have soared to more than $5.1 trillion, the highest level on record. Prior surges coincided with large Fed interest rate cuts in 2008 and 2020, Hartnett said.

The Fed is likely to cut rates very aggressively over the next 12 months, but that’s possibly going to start only after payrolls turn negative, Hartnett wrote.

Investors should sell equities after the last rate hike over the negative impact of higher unemployment, Hartnett said. “It’s now a longer-than-normal bear market” but policy intervention meant stocks have not priced in a large slump and biggest bull market recoveries “occur only after the biggest declines,” he wrote.

After stocks have taken the final lurch lower, “it’s secular leadership of inflationary cyclicals we will buy, not old leadership of credit, private equity, large cap tech.”

Among other notable flows:

- Inflows resumed to equities at $2.6 billion, with investors pouring $3 billion into emerging markets, while US stocks had redemptions of $1.7 billion

- Europe saw outflows of $1.3 billion over the past two weeks

- Among styles, US growth saw $3.5 billion of inflows while US value had $9.3 billion pulled out in the week

- Bonds have seen $1.2 billion of outflows over past two weeks

--With assistance from Michael Msika.

©2023 Bloomberg L.P.