Sep 20, 2022

BOJ Announces Unscheduled Bond Buying as Yields Stay at Ceiling

, Bloomberg News

(Bloomberg) -- The Bank of Japan announced an unscheduled bond-purchase operation as it seeks to cap upward pressure on yields before a policy decision later this week.

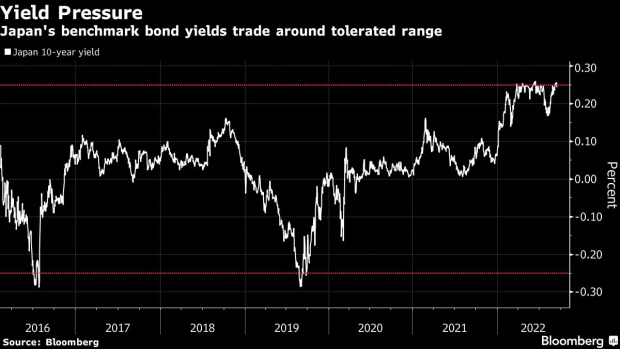

The BOJ said it would buy 150 billion yen ($1.04 billion) of debt due in five to 10 years, and 100 billion yen of securities maturing in 10 to 25 years. That’s in addition to the central bank’s daily offer to purchase an unlimited quantity of 10-year bonds at 0.25%. The 10-year yield climbed to the 0.25% upper limit of the BOJ’s tolerated range last week for the first time in three months.

“The unscheduled operation is a message to restrain rise in yields,” said Mari Iwashita, chief market economist at Daiwa Securities Co. in Tokyo. “It may also be a warning against some misguided speculation about a possible tweak to BOJ policy.”

Japanese bonds came under heavy selling pressure in June and only unprecedented central bank buying kept benchmark yields below the 0.25% ceiling. BOJ Governor Haruhiko Kuroda has emphasized his determination to maintain rock-bottom interest rates even as policy makers in many other developed nations increase them to rein in inflation.

Widening yield differentials between Japan and other major economies caused the yen to weaken to almost 145 per dollar this month, a level that’s held since 1998. The slide prompted Japan’s strongest warning yet that it would act to halt the currency’s decline.

©2022 Bloomberg L.P.