Aug 17, 2023

Brazil Binges on Russian Fuel Like Never Before

, Bloomberg News

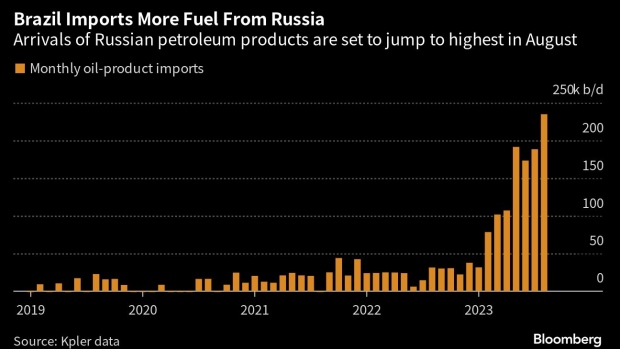

(Bloomberg) -- Brazil is poised to import a record amount of Russian fuel this month, consolidating its position as the Latin American country’s top supplier as Moscow builds new markets following a European Union ban.

Imports of Russian petroleum products is set to rise 25% from July to about 235,000 barrels a day, data from energy analytics firm Kpler Ltd. show. That far outstrips the US, which used to be Brazil’s top foreign fuel supplier.

Brazil started ramping up the purchases sharply in February, the month the EU banned imports and joined other Group of Seven nations in imposing a cap on Russian fuel prices. The US and its allies are trying to limit the flow of petrodollars into Russia to reduce funding for the nation’s war in Ukraine. The measures have reduced Russian fuel prices which need to price attractively in order to compete in new markets.

“Getting discounted barrels is a financial boon” to Brazil, where the government is always under pressure to lower the cost of transport fuels, said Viktor Katona, the lead crude analyst at Kpler.

The price threshold for Russian premium oil products such as diesel is set at $100 a barrel, while the cap for discounted fuel is $45 a barrel. Under the system, companies in G-7 nations can move Russian oil only if the cargoes cost less than those prices. Katona estimates that buying Russian diesel has lowered Brazil’s imported prices of the fuel by $10 to $15 a barrel.

Read: Russia Fuel Exports Hit 3-Month High in July on Diesel Surge

Since the cap came into effect, Brazil became the second-largest buyer of Russian diesel globally, lagging only Turkey, according to Kpler. Brazil has tried to take a neutral stance over who is to blame for the war.

Since June, Russia has also started supplying gasoline to Brazil, although at much smaller extent, and it’s possible naphtha shipments will also climb, according to Kpler.

“Brazil is the largest Latin American market, so Russian refiners are focused on supplies to the nation,” Katona said. “Even Brazilian companies admit that their buying of Russian diesel creates a competitive edge, so I’d expect it to continue going forward.”

--With assistance from Prejula Prem.

©2023 Bloomberg L.P.