Apr 3, 2023

Business outlook turns negative in Canada amid higher rates

, Bloomberg News

Canadian businesses are worried about consumer demand: Chief economist

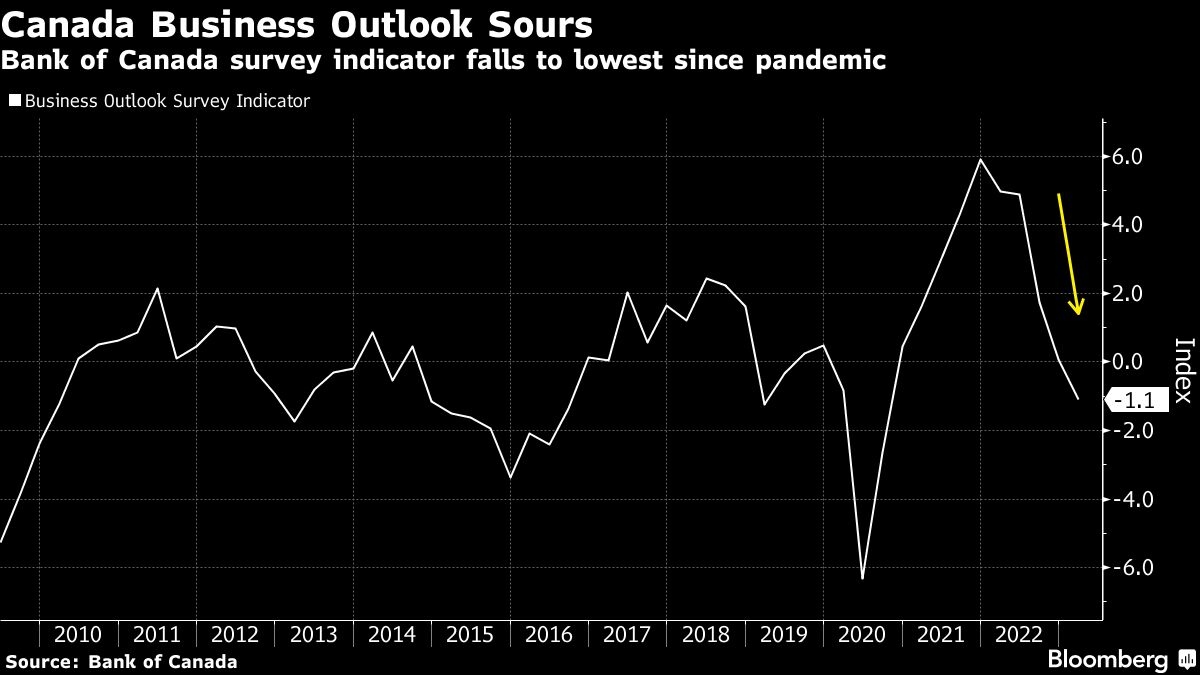

The outlook for Canadian businesses turned negative for the first time since 2020 and consumer expectations for inflation eased but remain elevated, central bank surveys show.

In the first quarterly reports since the Bank of Canada declared a conditional rate pause, both businesses and consumers see the economy heading to a mild recession in the next 12 months, with wage expectations still elevated amid a tight labor market.

The central bank’s business outlook indicator fell to -1.1 in the first quarter, from 0.1 previously. Firms expect slower sales growth for the fifth straight survey, due to higher interest rates, high inflation and concern about a recession.

The data suggest the Bank of Canada’s aggressive rate increases over the past year are working to drag down inflation expectations, and are starting to cool the domestic economy. Governor Tiff Macklem and his officials held the benchmark overnight rate at 4.5 per cent in March, with the next decision due on April 12.

While firms’ outlook for inflation has moderated, businesses still think it will stay well above the 2 per cent target until at least 2025. Businesses attribute persistent inflationary pressures mainly to high labor costs and strong domestic demand.

Consumers, meanwhile, said the central bank’s ability to bring inflation down is hampered by high government spending. Last week, Finance Minister Chrystia Freeland released a budget that sent Canada deeper into deficit with $43 billion (US$32 billion) in net new costs over six years.

About half of firms have incorporated the risk of a recession over the next year into their business plans. They expect any potential downturn to be mild, with some saying they’re less likely to add staff or increase investment spending.

The central bank also sees firms gradually shifting closer to their normal price-setting practices. Businesses also no longer expect labor costs to put upward pressure on output price growth.

“Today’s releases should encourage the Bank of Canada to remain on hold,” James Orlando, an economist at Toronto-Dominion Bank, said in a report to investors. While economic growth, employment and consumer spending have surged recently, Orlando said that “if consumers and businesses adjust their behavior in preparation of a slowdown, it becomes a self-fulfilling prophecy. This implies that the string of positive surprises won’t last much longer.”

A labor shortage intensity indicator turned negative for the first time in more than two years, thanks in part to immigration. Businesses view current labor shortages as less intense than a year ago and indicated that it has become easier to find the workers they need as new arrivals to Canada improve the supply of labor.

Firms said demand for labor remains healthy. More than half of businesses plan to increase the size of their workforce in the next 12 months. The average size of planned wage increases is still well above its historical average.

Private-sector workers participating in the consumer survey think their pay will increase at a higher rate in the next year. However, most said they don’t expect pay gains to keep up with inflation.

Consumers anticipate some relief in the housing market because they believe interest rates may fall earlier than previously expected. Now that the Bank of Canada has conditionally paused its rate increases, real estate prices are expected to rise modestly in the next 12 months.

Most Canadians see a recession as the most likely scenario in the next year. But many are uncertain about where the economy and the labor market are going, and those who are more uncertain are planning to spend less and save more as a precaution.

High inflation and rising interest rates are putting pressure on consumers — and particularly on mortgage holders. Consumers expect to spend less on travel, restaurant meals and other social activities than they did over the last 12 months. Most consumers still expect inflation in five years to be close to or above the bank’s inflation target range.

Rising interest rates have also added to pressure on households. Compared with how consumers viewed their financial positions during the 2017-18 tightening cycle, more than twice as many now say they’re financially worse off.

The surveys were taken before the failure of U.S. regional banks and the government brokered takeover of a European banking giant roiled global financial markets. However, the Bank of Canada said supplemental questions since then suggested the results were little changed.