Mar 22, 2024

Canada's economy to slow with new limits on temporary migrants

, Bloomberg News

Growing skepticism about immigration is a real political economy threat: Sean Speer

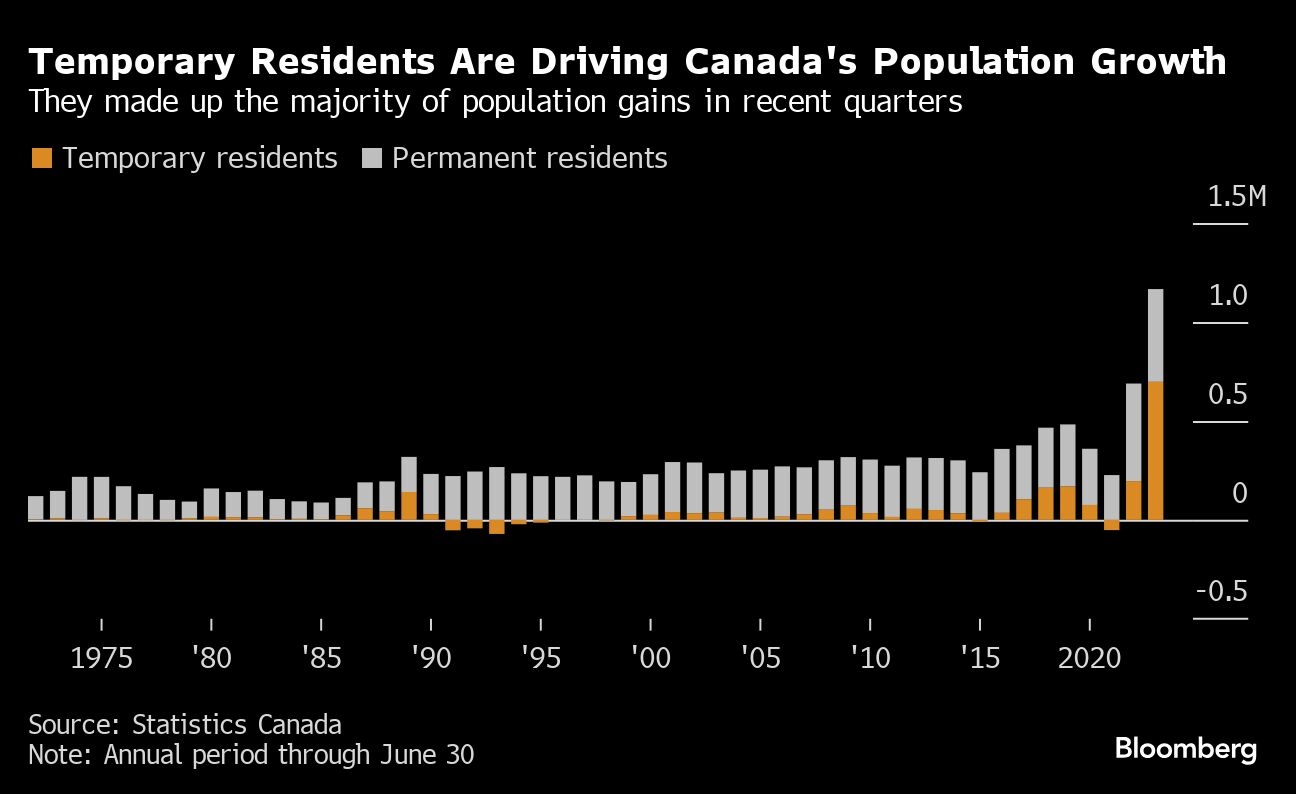

Canada’s planned reduction in temporary residents is set to add downward pressure to inflation and economic growth in the coming months, and the policy will likely halve its population growth rate when it takes full effect next year, economists say.

Prime Minister Justin Trudeau’s government plans to reduce the number of temporary immigrants by 20 per cent over the next three years, bringing the level down to 5 per cent of the population from 6.2 per cent currently. Starting in May, the government will make it harder for firms to rely on temporary foreign workers.

With one of the world’s fastest rates of population growth, the country has benefited from quickly expanding its labour force. But the rapid increase, driven primarily by foreign workers and students, has led to growing anxiety about housing shortages and the cost of living, prompting the Trudeau government to scale back its open immigration policies.

“This policy would have a material impact on the economy moving forward,” Royce Mendes, head of macro strategy at Desjardins, said in a report to investors. “The combination of a highly interest-rate sensitive economy and the likelihood of slower population growth are the main reasons we have been more bearish on the medium-term outlook for the Canadian economy.”

A decrease in temporary residents might offset the short-term economic benefits of any Bank of Canada rate cuts this year, Mendes said, adding that it could have an “even more severe impact” next year and in 2026 as population growth will be cut in half.

Robert Kavcic, an economist at Bank of Montreal, expects Canadian population growth to be slashed to near 1 per cent in the coming years, in line with the pace seen in the decade before the pandemic. The population has been growing around 3 per cent recently.

“The impacts will be: Less pressure on rents and housing, less stress and inflation in services, and lower interest rates than we otherwise would see if these inflows were to continue,” Kavcic said.

Worsening housing affordability was a major impetus for the government’s cap. Rent prices have been surging across major cities and have been a key contributor to consumer price increases in Canada. In February, the overall rate of inflation eased to 2.8 per cent on an annual basis, while rents jumped 8.2 per cent.

Excluding shelter costs, the consumer price index rose 1.3 per cent, below the central bank’s 2 per cent target.

“By way of just slowing the upward momentum in shelter inflation, this reinforces our view that the central bank will cut rates more forcefully than what’s implied by market pricing,” Desjardins’ Mendes said.

Currently, markets are pricing in more than three rate cuts by the end of this year, with a high probability that the Bank of Canada will begin that process in June.

The government’s immigration change will hurt businesses that are relying on importing low-wage foreign workers to fill jobs. According to the Canadian Federation of Independent Business, 22 per cent of small businesses in February said that a lack of unskilled or semi-skilled labour was impeding their ability to maintain their current operations or grow.

“The costs of bringing in a foreign worker are much higher compared to those associated with the hiring of someone already in Canada,” Christina Santini, CFIB’s director of national affairs, said in an emailed statement. “When employers turn to temporary foreign workers, it’s because they can’t find someone already in Canada.”