Mar 7, 2024

Canada's IPO drought reaches a full year with no end in sight

, Bloomberg News

IPO outlook: Public, private companies eagerly working on Ai

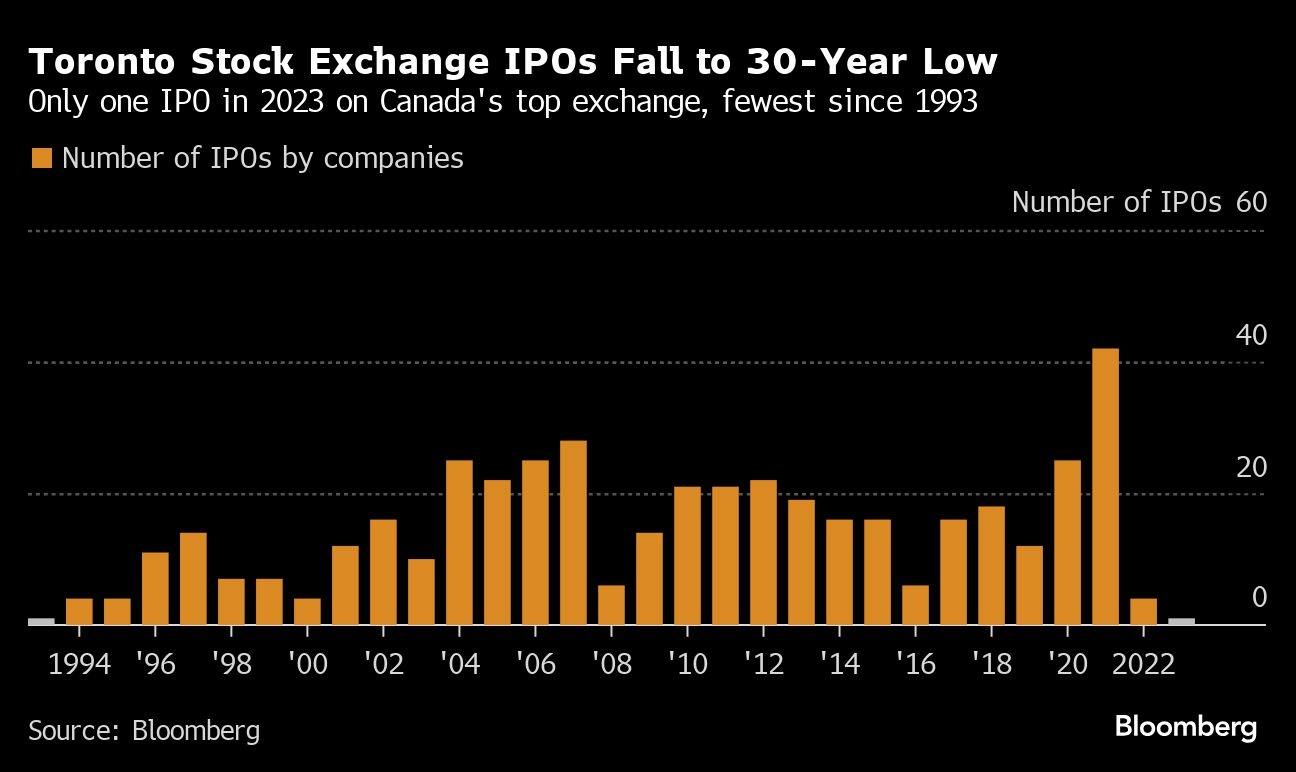

Canada’s biggest market for initial public offerings is marking a grim milestone of a full year without a new listing, and with investors focused on a narrow set of themes, senior bankers don’t expect relief before the second half of 2024.

The Toronto Stock Exchange is in the middle of an historic drought for IPOs; the last company to debut on the country’s premier venue was Lithium Royalty Corp. raised $150 million. The lack of new listings is raising concerns about the health of Canada’s equity markets as a place to raise capital.

“If Canada had an AI-related IPO, I’m sure it would fly off the shelves but it’s just that our economy isn’t focused on the sectors where investors want to put their money,” said Grant Kernaghan, head of Citigroup Inc.’s Canadian markets unit. Canada has yet to develop the breadth and depth in the technology, pharmaceutical and health-care sectors that exists in the U.S., he added.

Exchanges in the U.S. are seeing renewed activity in sectors investors want. Companies there have raised US$7.2 billion via IPOs this year, with consumer names like Wilson tennis racket maker Amer Sports Inc.’s US$1.6 billion offering and health care firm BrightSpring Health Services Inc.’s US$693 million IPO among the five largest, according to data compiled by Bloomberg.

“If you look at the IPOs that are happening in the U.S., they aren’t in energy, they aren’t in mining, they aren’t in banking and insurance,” Kernaghan said. “That’s three-quarters of the Canadian listed equity market.”

Diversification has been a challenge for Canadian markets for years, even as a handful of technology companies have successfully scaled up in the country, including Shopify Inc. and Constellation Software Inc. Still, technology stocks make up just 8.6 per cent of the S&P/TSX Composite Index, compared with the sector’s nearly 30 per cent weighting in the S&P 500.

Even on Canada’s junior exchanges, new stock issuance has been bleak. So far in 2023, one blank check company, Navion Capital II, has debuted and raised just $250,000.

Global lack of IPOs

Until recently, Canada wasn’t alone in wringing its hands over a lack of IPOs. Elevated interest rates helped push global volumes in 2023 to the lowest in over a decade, and although a rebound is starting to show its face in the U.S. and Europe, many in the industry have counseled patience.

“We are confident that the IPO market is poised for a comeback as conditions normalize,” said Loui Anastasopoulos, CEO of the Toronto Stock Exchange. He pointed to encouraging signs such as First Quantum Minerals Ltd.’s raising about US$1.15 billion in stock sales and US$1.6 billion from a notes offering last month, as well as other activity on the junior exchange.

“In our view, a rebound is likely to be spurred by increased financing activity among existing issuers,” Anastasopoulos said in an emailed comment. “We need to see more transactions, over a sustained period of time.”

An IPO rebound isn’t expected to take place before summer, according to bankers.

“I don’t see anything coming in the first half of the year,” said Peter Miller, head of equity capital markets for BMO Capital Markets. Conversations with prospective issuers make Miller more confident that there will be a handful of larger offerings in the second half, he said.

Canada’s ministries of finance and innovation declined to comment on whether the lack of new stock issuances in the space was concerning.

“Our economic plan is growing the Canadian economy,” said Katherine Cuplinskas, a spokesperson for Chrystia Freeland, the country’s finance minister and deputy prime minister. “We are creating the economic conditions and opportunities, as well as the necessary capital, for Canadian business to grow and succeed.”

Break the ice

At this point in Canada’s IPO winter, senior bankers expect it will take a large deal to break the ice and give confidence to small- and mid-cap issuers.

“Coming out of the drought that we’ve seen the last couple of years, I would expect we’ll see a focus on larger cap, more liquid names at least to open up the market initially,” National Bank Financial Markets vice chairman, equity capital markets Daniel Nowlan said in an interview.

Nowlan said the secondary offerings market has also been slow in 2022 and 2023, with total deal volumes in the low US$20-billion range. That’s roughly half of the historical average. Still, issuance in Canada rose to $3.1 billion in February, led by the First Quantum Minerals deal, data compiled by Bloomberg show — the highest level since Dec. 2022, when companies raised $3.6 billion, the data show.

An uptick in public debuts in the US market will also help provide a lift to IPO sentiment in Canada, according to BMO’s Miller, who said North American markets are integrated and the same investors buying into U.S. stocks are buying Canadian names.

Even as companies like Reddit Inc. prepare to hit the market in the U.S. in the coming weeks, bankers expect it will be months before prospective issuers try an IPO in Canada.

Miller described the expected second half rebound as a slow return to more normal activity levels.

“It’s not a snap back,” he said.