Apr 8, 2023

Canada’s Lassonde Plans to Buy Stake in Teck Spinoff: Report

, Bloomberg News

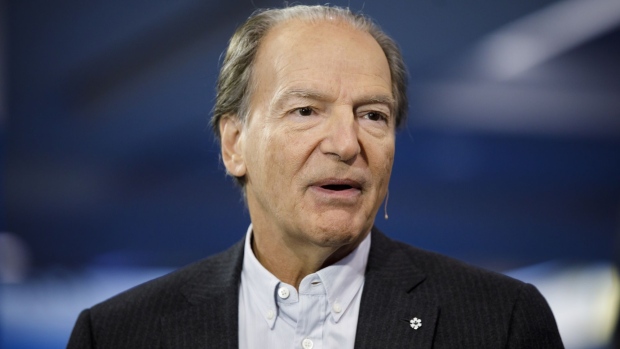

(Bloomberg) -- Canadian entrepreneur Pierre Lassonde is planning to buy a stake in Teck Resources Ltd.’s spinoff coal company to protect it from a foreign takeover, the Globe and Mail reported.

The plan comes after Switzerland’s Glencore Plc said this week it is still pursuing its $23 billion proposal to buy Teck, undeterred by rejections from both the mining company’s board and controlling shareholder.

Lassonde, co-founder of Canada’s Franco-Nevada gold royalty company, is an ally of Teck’s controlling shareholder Norman Keevil Jr., the Globe and Mail reported. Lassonde plans to take a large position in the new metallurgical coal company that Teck plans to split off from its copper and zinc business to keep it in Canadian hands, he told the newspaper in an interview on Friday.

Teck has valued the spinoff company, Elk Valley Resources, at C$11.5 billion ($8.5 billion) and its shares would be listed on the Toronto Stock Exchange on June 6, the newspaper said.

“I believe Elk Valley is fantastic, long-term value and I want this world-class asset to remain Canadian,” Lassonde told the newspaper.

Lassonde said he was surprised Elk Valley did not have a significant Canadian shareholder who could block a takeover attempt and he is now trying to put together a group of investors to buy between 10% to 20% of the company. He told the newspaper he intends to to put up more than a third of the cash to buy up to C$300 million of Elk Valley shares.

Read More: Teck Mining Magnate Stands Between Glencore and Mega Deal

Teck owns four copper mines in South America and Canada that produced 270,000 tons last year. The company expects to double copper output after the second phase of its Quebrada Blanca project in Chile ramps up to full capacity by the end of this year. It also owns coking coal mines, considered the crown jewel of its holdings.

Those assets make Teck appealing to global miners hunting for more of the industrial metals that underpin the global transition to cleaner energy.

Keevil Jr., 85, built the company with his father nearly six decades ago.

©2023 Bloomberg L.P.