Nov 5, 2021

Cannabis Canada Weekly: Canopy's disappointing Q2, Ontario retailers to face closures in 2022

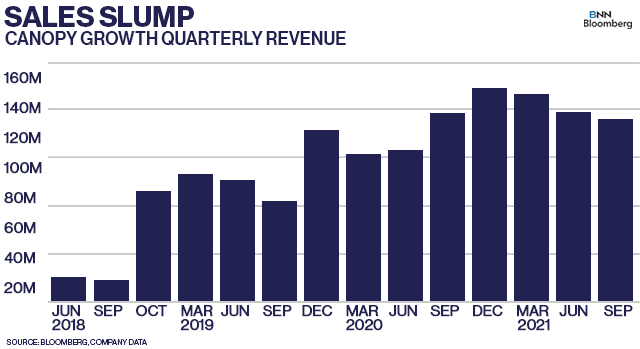

Canopy Growth reports disappointing Q2 results

Canopy's Klein hoping for stability in Canada's cannabis market following disappointing Q2

Canopy Growth Corp. feels like a company caught between a rock and a hard place.

On one side, it's trying to keep up with the fast-moving Canadian cannabis industry and minimize eroding market share as smaller and more nimble pot producers win more consumer dollars. On the other, it is trying to keep a close watch on the U.S. where it has a burgeoning CBD business while placing its flag with a handful of profitable producers that it can't wholly acquire due to the still-federal illegality of the drug.

The result has been a fickle group of investors which punished Canopy's stock, sending its shares down to a new four-year-low following second-quarter results that missed analyst expectations on both revenue and earnings.

Despite all the bad news, Canopy's Chief Executive Officer David Klein still thinks there's a reason for investors to remain bullish on the company and the cannabis industry as a whole.

"Progress in this sort of industry isn't going to be in a straight line," he said in an interview when asked what his message to his shareholders following Canopy's Q2 results. "So, I think that this is a very good entry point for investors, but you know, they have to be prepared for volatility in investing in a cannabis company at this point."

Klein said Canopy has plans to rebound in Canada's dried flower market by improving the quality of those products through better genetics and hang-drying plants before they're processed. They're also looking to turn products to market much faster and will work with third-party producers to quickly address consumer quality issues, he said.

"As a bigger company, what we have to do is we have to have the agility in our production environment in order to respond to those trends," he said. "You can't see what's happening in the market and then try to catch up. You need to be a bit ahead of that."

It remains to be seen if investors will be impressed by Canopy's moves in the flower segment. BMO Capital Markets Analyst Tamy Chen, who cut her target price on Canopy to $15 from $25 on Friday, questions why the company continues to struggle to meet customer preferences.

"We are left feeling uneasy that after almost two years at the helm, this management team is still being out-competed by smaller [licenced producers]," Chen said.

Despite Canopy's second quarter, the company still has $2 billion in cash to spend, although it burned about $300 million in the last quarter. Those funds don't appear to be earmarked for any further Canadian acquisitions with M&A activity focused on the U.S. market, for now, Klein noted.

However, Klein has stepped back from predicting when the U.S. will legalize cannabis, joking that "anything I say will definitely just be wrong". In the meantime, he hopes investors will focus on the work the company is doing to properly enter the U.S. cannabis market the moment the laws are changed. The company has a sizable CBD presence through its Martha Stewart CBD gummies business, vapes, and Quatreau drinks, but it also is set to acquire Acreage Holdings, a profitable U.S. multi-state operator, once legalization occurs, as well as edibles-maker Wana Brands.

"I do remain optimistic that it's going to happen sooner than later," Klein said. "But given the current logjam, where we can't even get an infrastructure bill that 70 per cent of Americans favour through the Senate, I just don't know how to call timing."

Klein also expects Canopy's chain of Tokyo Smoke stores will remain open over the next year despite a report by Chen that predicts some outlets will close up shop due to a concentrated retail environment. Access to the retail market is key for companies like Canopy to better understand what the customer wants.

"The difficulty in the market that we're in in Canada is consumer preferences are changing, but then also retailers' motivations and preferences are changing. As they're trying to learn how to compete with each other, they're continually moving their assortment, which affects our demand," Klein said.

"It just makes it hard to do business. But we believe that's going to settle down at some point and when it does, I think you'll see a lot more stability out of Canopy and from the other [licenced producers] as well."

THE WEEK'S TOP STORIES

Ontario expects to book $155M profit through its cannabis business

Ontario's cannabis business is set to make a $155 million profit in the current fiscal year, compared to $67 million in the prior fiscal year, according to the province's Fall Economic Statement released Thursday. Ontario also said it will receive $185 million in excise tax revenue from the federal government in the current fiscal year, up from $105 million in the previous year. According to Statistics Canada, Ontario sold $725.4 million worth of cannabis in 2020 - a number it already exceeded in the first eight months of 2021.

Expect to see some pot shops close in 2022: Analyst

Some cannabis stores in Ontario are expected to close over the next year thanks to a crowded market and tight margins, according to BMO Capital Markets Analyst Tamy Chen. Chen said in a note to clients Wednesday that cities like Toronto - home to nearly 400 cannabis stores - will likely see some of its pot shops close their doors, something that could lead to a year-over-year decline in industry sales. There are 1,143 cannabis retail licences issued in the province, which now contains more than half of the country's entire retail network. As well, RBC Capital Markets Analyst Douglas Miehm said in a recent report that the average monthly sales per marijuana store in Canada fell to less than $200,000 in August, compared to nearly $300,000 two years earlier.

Alberta to divest itself of online cannabis sales

Alberta is getting out of the online cannabis business after the province tabled a new bill aimed at reducing red tape and removing barriers to economic growth. Letting the private sector handle e-commerce sales would help boost licensed retailers' presence while stamping out illicit market dealers. Annual online marijuana sales in Alberta only accounted for about $200,000, according to the province. The legislation will also allow retailers to sell some branded clothing and other accessories as well.

Cannabis seen as one of America's most valuable agricultural crops: Leafly

Cannabis is believed to be the fifth-most valuable agricultural crop in the United States, according to a report released this week by Leafly. The report counts more than 13,000 cannabis farm licences in the 11 legal states where retail stores are open and found that farmers grow 2,278 metric tons of cannabis annually. That crop is valued to be worth US$6.175 billion, ahead of other agricultural products like cotton, rice and peanuts. Only corn, soybeans, hay, and wheat return more wholesale revenue to American farmers annually, Leafly said.

JP Morgan latest bank to forbid trading of U.S. cannabis stocks

JP Morgan is the latest U.S. bank to stop permitting their clients to buy certain U.S. cannabis-related securities given the risk they carry since marijuana is currently illegal under U.S. federal law, Reuters reports. The bank follows Credit Suisse and Bank of New York Mellon in similar moves made to stop accepting positions or trading with U.S. marijuana-related businesses. JP Morgan said in a letter to clients that the bank will not allow new purchases or short positions in the related businesses, but clients with existing positions will be allowed to liquidate them, the newswire reports. The new restrictions mainly apply to U.S. cannabis companies that trade on the Canadian Securities Exchange or other junior exchanges that allow trading of pot companies that directly engage with the plant.

ANALYST NOTE OF THE WEEK

CIBC on projected October sales figures

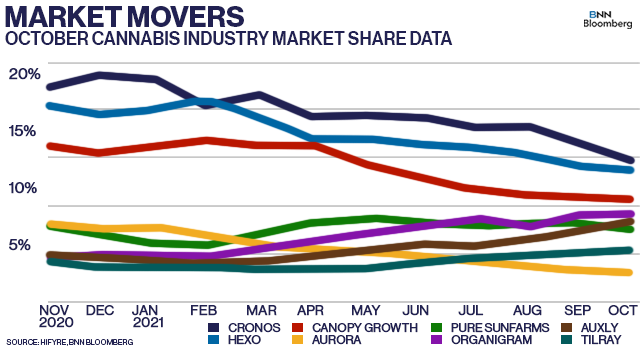

Some of Canada's biggest cannabis players continued to lose ground against their smaller counterparts, according to October Hifyre data cited by CIBC Analyst John Zamparo. Tilray, Aurora and Canopy Growth each saw double-digit sales declines in October while Auxly, Cronos and Organigram advanced in the month, Zamparo said. "Aurora's strategy to de-emphasize the recreational channel has been telegraphed, but achieving profitability for Aurora and Canopy Growth — and increasing profitability for Tilray —becomes much more difficult amidst results like these," he said. He sees the market share moves as further evidence of Canadian consumers’ price elasticity but also an ongoing lack of brand loyalty in the fast-moving market.

Zamparo noted that two brands owned by Organigram and Auxly, respectively, have emerged as some of the top products in their respective categories and interestingly, barely existed a year ago. None of these producers that posted share gains in October, however, generate positive EBITDA. Despite the market share moves, Zamparo now estimates 2022 cannabis sales to come in around $4.9 billion, compared to an annualized run rate of $4.2 billion using October's sales figures. Also of note for those "ankle biter" fans - cumulative sales for the country's top ten producers fell five per cent over the past month, while the rest of the industry's licensed cultivators saw their share rise by a similar amount.

CANNABIS SPOT PRICE:

$5.07 per gram

-- This week's price is down 1.3 per cent from the prior week, according to the Cannabis Benchmark’s Canada Cannabis Spot Index. This equates to US$1,856 per pound at current exchange rates.

WEEKLY BUZZ:

$811 million

- The amount of cannabis bought during the pandemic period that surpassed prior market projections, according to a recent study by researchers from McMaster University.