Oct 10, 2022

Cathie Wood Warns Fed of Policy Error as Rate Hikes Hit ARK ETFs

, Bloomberg News

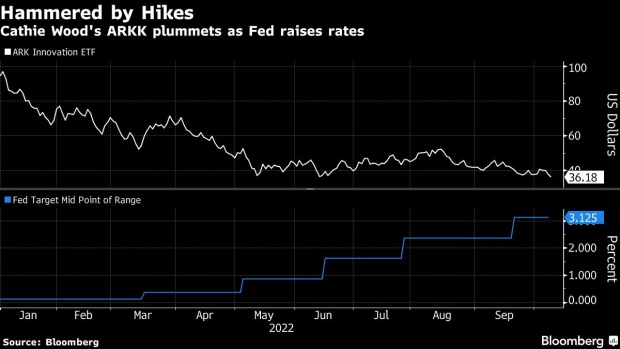

(Bloomberg) -- Cathie Wood, whose innovation-themed ETFs have plummeted in this era of rising interest rates, is taking the Federal Reserve to task for its aggressive tightening campaign.

In the latest market commentary from her firm ARK Investment Management, Wood pens an open letter to the Fed expressing concern that the central bank is making a policy error with its rapid rate hikes.

She warns that the central bank could be raising the risks of a deflationary bust, pointing to a slew of falling commodity prices and retailers’ growing inventories as key indicators. The money manager argues that, in targeting price growth and jobs numbers, the central bank is focusing on the wrong barometers.

“The Fed seems focused on two variables that, in our view, are lagging indicators -- downstream inflation and employment -- both of which have been sending conflicting signals and should be calling into question the Fed’s unanimous call for higher interest rates,” Wood wrote.

Unmentioned in the letter is the performance of her suite of ARK funds. They had beaten much of the US market in 2020, when investors piled into speculative trades amid loose monetary policy. But this year, as the Fed embarks on tightening, all her funds have fallen more than 30%, with the flagship ARK Innovation ETF (ticker ARKK) tumbling 62%. That compares with the S&P 500’s drop of 24% this year.

©2022 Bloomberg L.P.