May 1, 2023

Celebrating 50 years of professional technical analysis: Larry Berman

By Larry Berman

Larry Berman's Educational Segment

The Chartered Market Technicians (CMT) Association (formerly known as the Market Technicians Association MTA) celebrated its 50th anniversary in New York last week.

My friend, Ralph Acampora, who was one of the original founders, kicked off the event with an always passionate talk about the history of the organization. I joined the board of directors in 2005 and served as president from 2008 to 2010 during the global financial crisis.

Currently, I serve as a subject matter expert in behavioural finance and help create exam questions for the CMT program.

Back in 2004, the U.S. regulatory bodies the Securities and Exchange Commission (SEC) and National Association of Securities Dealers (NASD) demanded that all analysts be certified with certain fundamental credentials (Series 86) in the aftermath of the dot com bubble and the Sarbanes-Oxley Act. They would not accept the CMT accreditation and only accepted the Chartered Financial Analyst (CFA) accreditation for the newly minted Series 86 exemption. Our organization was outraged; imagine that, the securities regulators wanted a technical analyst to become a fundamental analyst in order to be certified to give technical analysis advice.

In 1973, the organization was founded on the principles, among others, to develop the professionalism of technical securities analysis and to study the effects of investor psychology and behavioural patterns upon securities analysis. In 2004, the MTA task force had an audience with the SEC/NASD to gain an exemption for the CMT. After hours of testimony to explain what technical analysis and the CMT exam is all about, one of the lawyers pointed to a chart and asked what about it was fact compared to fundamental analysis? Acampora answered, “Price is fact, earnings are estimated and revised.” A few months later, the CMT charter was approved as an exemption to the Series 86 requirement and now on par with the CFA in the eyes of the regulators.

As the first person in Canada to hold both a CFA and CMT charter, I’ve always felt that both were important skills when evaluating securities. But when it comes to sentiment, the emotional impact of decision making is not picked up in fundamental analysis. It simply lacks the practical application of the human interaction with one’s money.

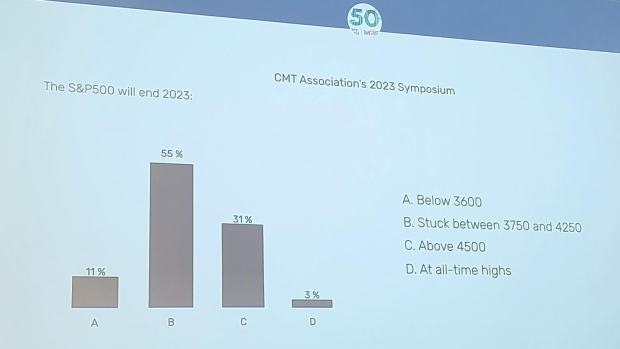

To kick off the event, a sentiment survey was asked of the more than 300 professional technical analysts that attended the symposium.

The results were telling. About 34 per cent would be considered bullish while only 11 per cent would be considered bearish. The highest percentage was for a neutral outcome within the range of the first four months of the year.

We were not asked if the market would deviate from the range first, which I suspect it will. My call was B, but I do think we can see new lows this year if inflation remains sticky and the Federal Open Market Committee (FOMC) can’t cut rates as the market currently expects.

If that forces the U.S. Federal Reserve to ease, then we could easily be back into the range by the end of the year. As for this week, expect the FOMC to raise rates 25 bps and keep the door open to increasing rates more if inflation remains sticky. If labour markets remain strong, there is a very low chance we see them cut rates this year. We need to see financial conditions tighten (higher rates, weaker equities) before stimulus would be appropriate in the face of sticky inflation.