Aug 23, 2022

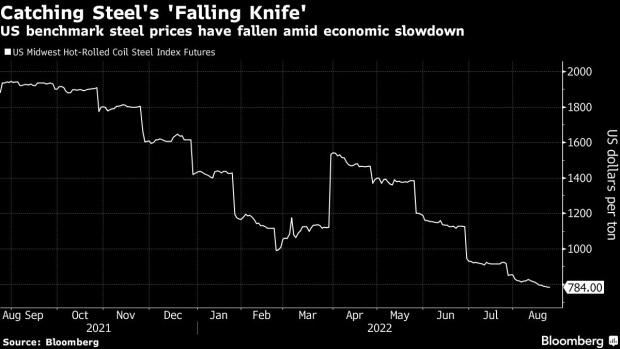

CEO Who Dubbed Steel Market a Falling Knife Is Calling a Bottom

, Bloomberg News

(Bloomberg) -- The CEO who warned at the beginning of the year that North America’s steel market was a “falling knife” is calling an end to the carnage.

Stelco Holdings Inc. Chief Executive Officer Alan Kestenbaum said that while his company has seen a downturn in the automotive and construction sectors, demand for steel is doing “OK”. The energy sector is very strong, according to Stelco, and its order book has been filling up quickly in recent weeks.

“There was a lull in the beginning of July and of late things have been moving pretty quickly in terms of the order book,” Kestenbaum said Tuesday in a phone interview. “Things are going to stay steady as we get to the end of the year and I don’t see any further breakdown in price.”

Benchmark steel prices are down more than 45% this year amid a slowdown in economic growth, a rise in inflation and ongoing supply-chain problems preventing automakers and developers from finishing projects. Kestenbaum said the Hamilton, Ontario-based steelmaker has seen better pricing the last few weeks, breaking the downward trend.

While construction has faced headwinds, there are green shoots on the horizon, according to Ken Simonson, chief economist for the Associated General Contractors of America. US states will begin breaking ground for projects that are part of Congress’s infrastructure bill passed last year, with large orders for key materials like steel showing up in early 2023, he said at an industry conference in Atlanta. And while automakers lag full production due to ongoing chip shortages and issues with parts availability, consumers will continue to snap up everything Detroit can roll onto dealer lots.

Kestenbaum said the car industry is building about 13 million to 14 million automobiles per year, which is a far cry from the lean period during the 2007-2009 economic downturn. Automobiles use about 1 ton of steel per car.

“It’s not like the Great Recession or Covid where demand just totally disappeared,” he said. “At that point the auto industry was consuming just 6 million to 7 million tons a year, and during Covid the factories were shutting down.”

While Stelco’s CEO doesn’t see a further decline in prices, Kestenbaum said he also doesn’t anticipate an unexpected surge.

©2022 Bloomberg L.P.