Mar 31, 2023

Chaos in Banks Buoy Short Sellers Hit by Tech Stocks’ Surge

, Bloomberg News

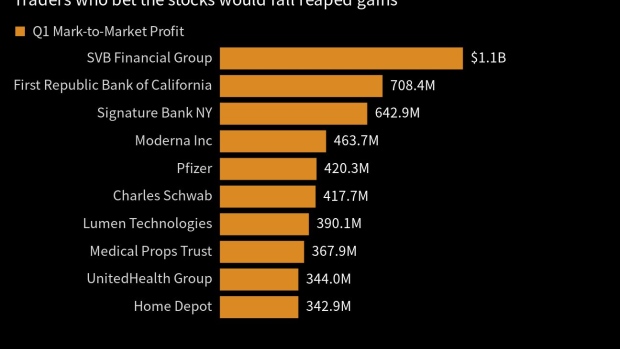

(Bloomberg) -- Investors betting against bank stocks earned more than $2 billion this quarter as turmoil engulfed the battered sector, making the shares the most profitable for short sellers to start 2023.

Speculators who sold borrowed shares of collapsed lender SVB Financial Group, wagering the stock would decline, reaped the biggest windfall — a mark-to-market profit of roughly $1.1 billion through Thursday, data compiled by S3 Partners show. First Republic Bank and Signature Bank rounded out the quarter’s three most profitable shorts.

The results highlight the forces at play in markets to start 2023, which saw investors flood back to beaten-down tech stocks with strong balance sheets and cash flows. Meanwhile, the crisis that enveloped banks crushed those shares broadly.

“In recent memory, I’ve never seen banks in the top shorts,” said Ihor Dusaniwsky, S3’s head of predictive analytics, who has tracked the data since 2015. “Usually their price changes are not as dramatic as the tech and health-care stocks.”

Stark Divide

Benchmark indexes lay out the stark divide in performance. The KBW Bank Index is down about 19% this year, for its worst quarter since early 2020. Meanwhile, the tech-heavy Nasdaq 100 Index is up about the same amount and entered a bull market Wednesday. It’s a stunning recovery for tech, after the Nasdaq 100 tumbled 33% in 2022, its worst year since the great financial crisis.

For short sellers, the hit from the tech sector overwhelmed gains elsewhere: The group is on track for a loss of roughly $47 billion this quarter, according to S3. It follows last quarter’s loss of about $44 billion, a period when the S&P 500 Index was starting its recovery from last year’s lows.

Tesla Inc. proved to be the short trade that dealt the most pain this quarter, with mark-to-market losses of more than $6.7 billion as the shares rebounded from a brutal 2022. It’s a big swing from last year, when investors betting against the electric-vehicle maker earned about $17 billion, making it the best-returning short target.

Nvidia Corp., Meta Platforms Inc. and Apple Inc. also lost short sellers billions of dollars this quarter.

A key part of the narrative is that US chip stocks that were pummeled last year have bounced back, spurring traders’ hopes that shares of semiconductor companies have indeed bottomed.

Next Step

The question now is whether it’s a temporary mean-reversion play to start the year or a green light to go all-in on those stocks, given widespread expectations for a recession this year.

In a sign of how pricey the shares have become, the ratio of chip stocks to regional banks is around its highest ever, data compiled by Bloomberg show. It’s at a level that rivals peaks before the bursting of the dot-com bubble in 2000, as well as in 2020 when traders piled into so-called growth stocks, powering major US indexes back to records after markets were shaken by the pandemic.

Coming into this week, the ratio of the Philadelphia Semiconductor Index versus the KBW Regional Bank Index saw the largest 10-day rate-of-change since 2001, at 28%, according to Jonathan Krinsky, chief market technician at BTIG. Now, he says a pullback wouldn’t be surprising for chip stocks.

“The tech trade will eventually run its course,” Krinsky said. “Once those rotations are done and long-only money managers can’t buy anymore tech, that’s when the group becomes vulnerable.”

--With assistance from Jeran Wittenstein.

(Adds total paper profit for bank shorts in first paragraph.)

©2023 Bloomberg L.P.