Apr 11, 2023

China 10-Year Bond Yield Drops to Lowest Since November

, Bloomberg News

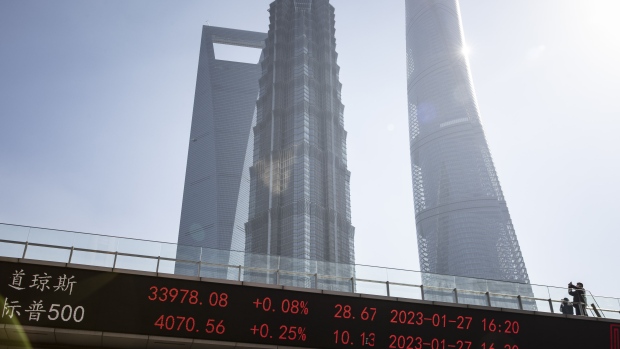

(Bloomberg) -- Traders are piling into China’s government bonds, driving benchmark yields to the lowest since November on bets that more monetary easing may be on the way.

The nation’s 10-year sovereign bond yield fell as low as 2.81% on Wednesday after China’s subdued inflation data highlighted the scope for more policy support. The move takes the yield’s decline from the year’s high to 12 basis points.

Chinese bonds have emerged as an oasis of calm as outsized swings rock Treasuries and other major bond markets amid a raging debate over the global fight against inflation. The People’s Bank of China is one of the few central banks with an accommodative stance, which has also helped boost the appeal of the nation’s equities and corporate debt.

“There seems to be increased expectation for more monetary easing,” said Frances Cheung, rates strategist at Oversea-Chinese Banking Corp. in Singapore. “The rapid increases in bank deposits together with the soft print of CPI may suggest that consumers have remained cautious which argues for some more support.”

Hopes for more monetary easing are mounting after data released this week showed China’s March consumer inflation trailed economists’ estimates, while producer prices posted the worst deflation since June 2020.

The rate-cut speculation will be put to the test next week when the PBOC decides the interest rate and amount of loans it will offer to replace a 150 billion yuan ($21.8 billion) one-year medium-term lending facility due.

All but one of 11 economists surveyed by Bloomberg see the central bank holding the interest rate at 2.75%, with the most recent cut taking place in August. Haibin Zhu, Chief China Economist at JPMorgan Chase & Co., is an outlier with a 10 basis-point cut forecast.

Some smaller Chinese lenders cut interest rates for term deposits over the weekend, following a similar move by their larger rivals, after several lending rate reductions by policy makers started to squeeze their margins. The PBOC unexpectedly lowered the reserve requirement ratio last month.

Even so, the PBOC may hold back on more easing to avoid widening its rate differential with the US as the the Federal Reserve is still expected to hike.

China is set to release a slew of economic data next week starting with first-quarter growth, which is expected to rebound to 3.8% from 2.9%. Figures on industrial production and retail sales are also likely to show an improvement.

“If upcoming economic data next week turned out strong and the MLF operation disappoints speculators with a steady rate, the bond market may come under some correction pressure,” Zhang Xu, head of fixed income research at Everbright Securities, wrote in a note.

Still, the relative stability of China’s debt may be a drawing point. On average, China’s 10-year yield has moved by less than one basis point daily since the start of the year, compared with seven basis points for its US counterpart, according to data compiled by Bloomberg.

--With assistance from Chester Yung.

©2023 Bloomberg L.P.