Apr 26, 2023

China and the Fed Keep Investors Swinging Between Oil and Gold

, Bloomberg News

(Bloomberg) -- The classic commodities recession play of switching from oil to gold is well underway, but it’s far from a smooth progression as investors juggle signals from the Federal Reserve and China’s stuttering post-virus recovery.

The oil-gold ratio — the spot price of bullion divided by West Texas Intermediate oil futures — is a barometer for the state of the global economy, with higher readings suggesting investors are positioning for a recession. The ratio has been rising since mid-2022 and spiked in late March as the banking crisis boosted gold’s allure as a haven.

The last time there was a dramatic move in the ratio was in 2020 as Covid-19 engulfed the global economy, pushing up gold and sending oil into a tailspin. This time round, the situation is less clear-cut.

When precisely the Fed stops raising rates is a big question for the two key commodities. Trying to anticipate the timing of the pivot has led to some counter-intuitive moves of late, with oil, a risk asset, often rising on weak US economic data, while haven-play gold drops.

“Risk assets have generally rallied on the back of negative macro releases, given that it could signal nearing the end of Fed hiking,” said Warren Patterson, head of commodities strategy for ING Groep NV. “What makes it a difficult environment is knowing when bad news stops being good news.”

China is complicating the equation: Its post-virus recovery hasn’t lived up to expectations, but most analysts still expect higher demand from the biggest oil importer to kick in at some point.

The so-called “OPEC Put” — when the cartel steps in to prop up oil prices — is one of the other big unknowns for oil investors, with the alliance’s announcement at the start of April sending the ratio into retreat. The progress of China’s recovery, with air travel activity from Golden Week in early May a key signpost, is another.

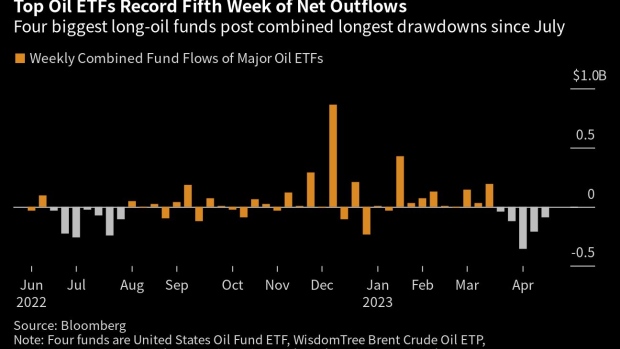

Some analysts still see prices moving higher from here, on the hopes that increased buying from Chinese refineries will offset a worsening economic situation in the US. That optimism has ebbed in recent weeks, however, with a quartet of the four largest exchange-traded funds logging five straight weeks of outflows.

That’s a lack of consensus on where oil prices are headed. Goldman Sachs Group Inc. is still characteristically bullish, seeing Brent oil rising to $95 a barrel by December from around $78 at the moment. Citigroup Inc., however, sees the global benchmark below $80 a barrel.

“There is a particularly large gap between optimists and pessimists” in oil markets, Standard Chartered Plc analysts including Emily Ashford and Paul Horsnell said in a note in mid-April.

Gold Looking Lustrous

What’s bad news for oil is typically good news for gold, and that’s been reflected by the world’s largest gold fund — the SPDR Gold Shares ETF — which has seen strong inflows since mid-March.

Spot gold has rallied from around $1,630 an ounce in early November to around $2,000 — not far from a record high — as investors bet the Fed was moving closer to ending its rate-hike cycle. Lower bond yields usually benefit the non-interest bearing asset.

China’s disappointing recovery and the prospect of a destabilizing debt-ceiling fight in the US are also supporting the precious metal.

Falling yields are typically good for gold, but bullion still stands to do well from rising yields on long-end fixed income as the US struggles with a looming debt-ceiling crisis, said Edouard de Langlade, founder of macro hedge fund EDL Capital AG. “I think gold is going to go up a lot.”

Citi said it sees gold reaching $2,300 an ounce in six to 12 months in a note this month that cited the recent banking turmoil in the US together with an increase in bullion buying by emerging-market central banks in China and other markets.

Heightened geopolitical risks, particularly worsening US-China relations, along with stubbornly high inflation are aiding gold, said Kelvin Wong, a senior market analyst at Oanda Asia Pacific Pte Ltd.

“In the current economic context, gold will tend to do well in a stagflationary environment,” he said. However, “we are now faced with conflicting macro news flow and data releases,” Wong said.

--With assistance from Sybilla Gross.

(Updates with investor quote in 14th paragraph.)

©2023 Bloomberg L.P.