Dec 21, 2022

China Buys a Record Amount of Russian LNG as Oil And Coal Purchases Also Surge

, Bloomberg News

(Bloomberg) -- China imported record quantities of Russian liquefied natural gas last month, while sales of crude oil and coal also surged as other buyers shunned Russian energy products as punishment for its invasion of Ukraine.

Russian sales of LNG doubled from a year earlier to 852,000 tons in November, despite a 5.4% decline in China’s total purchases of the super-chilled fuel, according to Chinese customs data. Natural gas piped overland from Russia may have risen as well, in line with increased total pipeline imports recorded by customs, although China hasn’t broken out how much comes from its neighbor since the start of the year.

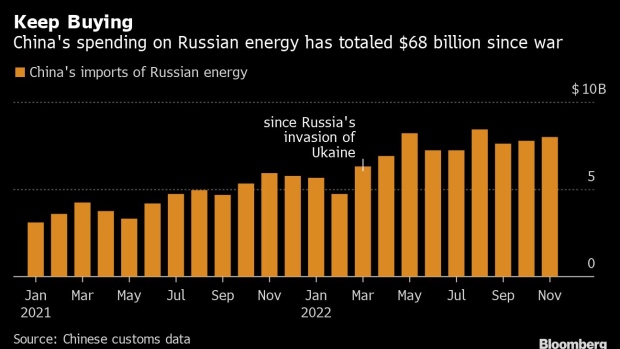

Overall purchases of Russian energy, including oil products, hit $8 billion in November, from a revised $7.8 billion in the prior month. The total now stands at $68 billion since the war in Ukraine began, from $41 billion over the same period last year. The record for a single month was the $8.4 billion set in August.

Oil imports from Russia in November rose 17% from a year earlier to 7.81 million tons, the highest total since August and overtaking Saudi Arabia as China’s top supplier. Russia’s seaborne crude shipments have since collapsed after the Group of Seven nations imposed measures targeting Moscow’s petroleum revenues earlier this month, including a drop-off in cargoes to Asia affected by the terms of the sanctions.

Coal imports from Russia, including brown coal, soared 41% to 7.2 million tons. Some 2.1 million tons of that was coking coal for the steel industry, twice the amount of a year ago, but lower than the record hit in September.

Russian sales grew despite a steeper contraction in China’s imports from the previous month. A slowing economy constrained shipments of items from gas to copper, although crude purchases were a bright spot as refiners responded to the prospect of a surge in fuel exports after Beijing issued its biggest quota this year.

Other data for imports from Russia in November (compared with a year earlier):

- Refined copper imports surged 29% to 43,101 tons

- Refined nickel imports increased 37% to 6,247 tons

- Refined aluminum imports rose more than threefold to 56,122 tons

- Palladium imports soared 28% to 416 kilograms

- Gold imports declined 7% to 692 kg

- Wheat imports jumped 1.7 times to 5,854 tons

The Week’s Diary

(All times Beijing unless noted otherwise.)

Wednesday, Dec. 21

- Australian Foreign Minister Penny Wong visits Beijing

- China Nov. output data for base metals and oil products

- CCTD’s weekly online briefing on China’s coal market, 15:00

Thursday, Dec. 22

- Nothing major scheduled

Friday, Dec. 23

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

On The Wire

Iron ore rose - extending Tuesday’s climb - as China’s snap Covid Zero reversal and a steady stream of supportive policies improved prospects for a recovery in the housing sector.

©2022 Bloomberg L.P.