Apr 10, 2024

China Consumer Price Gains Fade With Industry Stuck in Deflation

, Bloomberg News

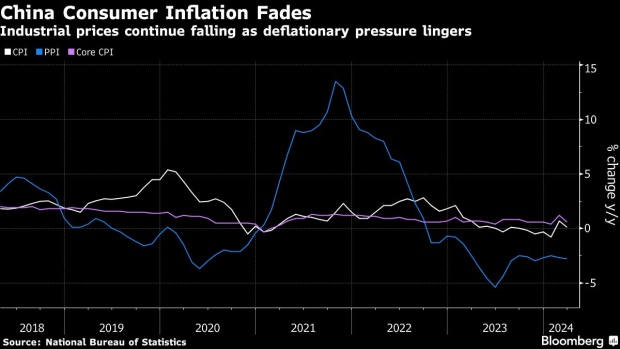

(Bloomberg) -- China’s consumer prices barely increased from a year earlier and industrial prices continued to slump, underscoring the deflationary pressures that remain a key threat to the economy’s recovery.

The consumer price index rose 0.1% in March from the prior year, the National Bureau of Statistics reported on Thursday. The median forecast of economists in a Bloomberg survey was a 0.4% gain. The inflation rate dropped from 0.7% in February, when it had climbed above zero for the first time in six months during the Lunar New Year holiday. Producer prices fell for an 18th straight month.

The price slowdown suggests China may not get much help from local shoppers to meet growth targets that increasingly rely on selling its manufactured goods abroad. What’s more, with US inflation moving in the opposite direction, there’s a risk of an enduring interest-rate gap between the world’s two biggest economies that could add downward pressure on the yuan.

“The price data clearly mirrors the weak domestic demand,” said Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd. “The recent improvement in momentum is primarily export-driven.”

Before China’s CPI numbers came out, the central bank signaled continued support for the currency, after the offshore yuan weakened by the most in three weeks overnight on the US inflation surprise. It set its daily reference rate at 7.0968 per dollar, exceeding forecasts by the most on record. A gauge of Chinese stocks listed in Hong Kong dropped as much as 1.8% early Thursday, before paring some losses.

Higher inflation during the February holiday season, along with a tourism revival, had raised hope that Chinese households might be rediscovering their appetite to spend. Absent that, the country’s ability to hit its economic growth target of around 5% this year depends on overseas demand. Buoyant exports and factory activity data in recent weeks encouraged Goldman Sachs Group Inc. and Morgan Stanley to raise their growth forecasts this week.

Read More: Goldman, Morgan Stanley Boost China’s 2024 Growth Outlook (2)

The slowdown in consumer inflation was due to “waning consumption demand in March seasonally after the holiday while market supply was generally sufficient,” said NBS analyst Dong Lijuan in a statement accompanying the release of the figures.

What Bloomberg Economics Says...

“It’s clear deflationary pressures will not abate unless policy turns more supportive. We expect the People’s Bank of China to cut rates in the second quarter.”

- Eric Zhu, economist

Read the full report here.

Food price drops pulled the headline CPI number down by 0.5 percentage point, and the year-on-year increase in tourism prices slowed to 6% from 23% in February. Household appliances, and a transportation index that includes cars, extended a slide that’s lasted for more than a year. The government this week announced action plans to boost demand by offering subsidies for households that trade in older machines for new, greener models.

With the housing-market slump showing no signs of a turnaround, subdued demand for building materials like steel is dragging producer prices down. The overall index declined 2.8%, extending the longest falling streak since 2016. Metal smelting and pressing costs fell at an annual rate of 7.2%, while mining and washing of coal — used for steelmaking — tumbled 15%, the most among all main industries.

Fading inflation may still ramp up pressure on China’s government to offer more support for the economy. Falling prices squeeze companies’ profit margins, discouraging them from investment, and there’s a risk consumers could become even more reluctant to spend in anticipation that goods will be cheaper in the future.

“Monetary policy will likely remain loose,” said Bruce Pang, chief economist for Greater China at Jones Lang LaSalle Inc. But he pointed to a constraint for Chinese central bankers: higher-than-expected US inflation could delay easing by the Federal Reserve. That would make it harder for China to trim its own rates — even though it needs to — due to concern about further weakening of the yuan, Pang said.

Read More: China Ramps Up Yuan Support as Fixing Tops Estimates by Record

In a sign that deflation could continue to haunt the economy in the coming months, price competition in some industries has intensified lately. Companies that produce materials for construction, like zinc smelters, have been forced to lower their charges because of excess capacity while electric-car producers are offering aggressive discounts to lure customers.

Core inflation, which strips out volatile food and energy prices, slowed to 0.6% last month from 1.2% in February, according to the NBS.

--With assistance from Zhu Lin and Yujing Liu.

(Updates with analyst comments.)

©2024 Bloomberg L.P.