Nov 8, 2022

China Developers Soar as State Help Fuels Bets on Market Bottom

, Bloomberg News

(Bloomberg) -- Chinese developers surged Wednesday, the latest example in recent days of investors seizing on potential positives to bet that the bottom is in after more than a year of wrenching declines.

A Bloomberg Intelligence stock gauge climbed as much as 10% before paring gains to less than 6%. Country Garden Holdings Co. and CIFI Holdings Group Co. surged at least 14%. Property firms’ dollar bonds rose as much as 5 cents, according to credit traders, just days after a developer-dominated index of junk notes ended a monthlong-streak of daily declines.

A key bond regulator on Tuesday expanded a financing support program launched in 2018 to support about 250 billion yuan ($34.5 billion) in debt sales by private companies including China’s cash-strapped builders. The sector has been embroiled in a debt crisis for over a year, with offshore debt defaults mounting to unprecedented levels and slumping new home sales worsened by the government’s Covid policy.

The property sector’s gains Wednesday followed a broad surge in Chinese equities last week on a flurry of market-friendly headlines and unverified talk that China was poised to exit its strict Covid Zero policy. Sharp declines last month left developers’ stocks and bonds primed to shoot higher at the first scent of upbeat news, though rallies in the sector’s securities have repeatedly fizzled this year.

“Given repeated policy disappointments, we think it pays to be conservative regarding the amount of aid that would go toward the property sector,” BofA Securities analysts including Karl Choi wrote in a report. “We believe that the real game changer is physical-market sales recovery, which we project will remain under pressure in 2023.”

So far, government measures to help the property sector have largely been piecemeal and focused on getting under-construction homes completed, not helping developers meet debt obligations.

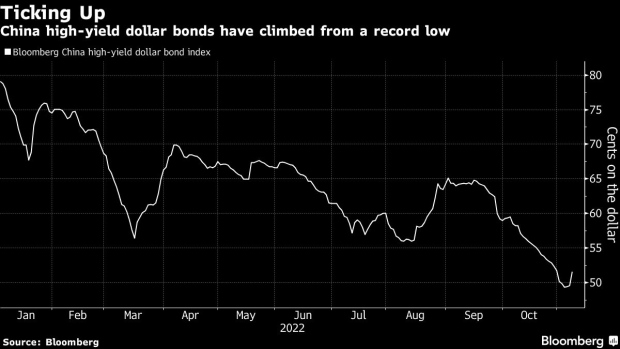

The average price for Chinese junk-rated dollar bonds hit a record-low 49 cents last week, part of a rout that has its roots in a crackdown that started in 2020 on excessive leverage at developers and speculation among homebuyers. It’s been worsened by Covid restrictions that have exacerbated falling home sales. But note prices are on pace for their first four-day uptrend in three months.

The latest help outlined by NAFMII would include bond guarantees, an effort that emerged in August for select builders to sell such debt onshore backed by state-owned China Bond Insurance Co. in light of the sector’s liquidity crunch. While the sector’s stocks and bonds initially rallied on that plan, the gains reversed as fresh worries surfaced about developers’ debt-repayment capabilities as new-home sales continued to slump.

CIFI, one of the initial sellers of a guaranteed local note, last month defaulted on a convertible-bond payment, causing fresh tumult in the sector.

“All efforts by the government should be appreciated -- as least they want to do something,” said Ting Meng, senior credit analyst at ANZ Bank China Co. “If the money is to support the developers with tight liquidity only, it could help.” But she said the money would be “far from enough” if builders which have defaulted or extended debt also participate.

NAFMII’s announcement came a week after a major state-owned financial newspaper said the central bank-governed entity held a meeting with 21 developers about issuing notes backed by China Bond Insurance. Days before the meeting, a top official at the People’s Bank of China asked the debt insurer to step up support for bond sales by private-sector builders.

More “incremental policies” like NAFMII’s move are likely, according to Owen Gallimore, head of APAC credit analysis at Deutsche Bank AG. He said there’s already been some momentum building, with home prices in large Chinese cities rising slightly from a year earlier and sales picking up sequentially from last spring’s levels.

(Updates with closing prices.)

©2022 Bloomberg L.P.