Jul 12, 2022

China Developers Suffer Broad Bond Selloff Amid Lockdown Fears

, Bloomberg News

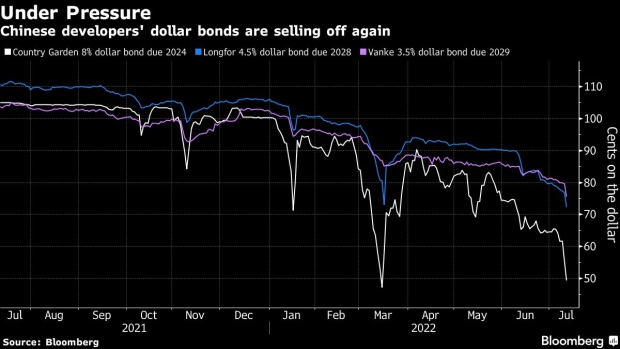

(Bloomberg) -- Dollar bonds of Chinese developers fell across the board Tuesday, with stress spreading from junk-rated names to investment-grade peers amid renewed concerns about more Covid lockdowns in the country.

High-yield notes from the sector dropped as much as 2 cents on the dollar, according to credit traders, led by Country Garden Holdings Co., China’s top builder by contracted sales. Investment-grade dollar bonds from peers Longfor Group Holdings Ltd. and China Vanke Co. were poised to set record lows.

The bond weakness has occurred as a Covid-case spike in Shanghai and other parts of China sparks fears that authorities will re-impose strict control measures which may bring an already-struggling economy to its knees. The country’s real estate sector suffered enormously from lockdowns earlier this year, with slumping home sales making life even harder for cash-strapped builders.

A Bloomberg index shows that Chinese junk dollar bonds, a market dominated by developers, haven’t had a daily gain in more than five weeks.

©2022 Bloomberg L.P.