Feb 28, 2023

China Factory Activity Surges to Decade High, Boosting Recovery

, Bloomberg News

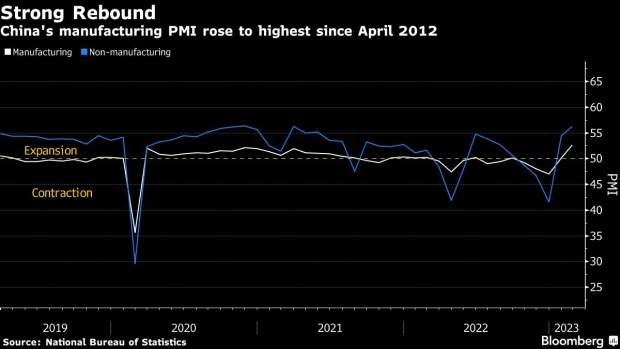

(Bloomberg) -- China’s economy is showing signs of a stronger rebound after Covid restrictions were abandoned, with manufacturing posting its biggest improvement in more than a decade, services activity climbing and the housing market stabilizing.

The manufacturing purchasing managers’ index rose to 52.6 last month, the National Bureau of Statistics said Wednesday, the highest reading since April 2012. A non-manufacturing gauge measuring activity in both the services and construction sectors improved to 56.3. Both indexes beat economists’ expectations.

The PMIs provide the first comprehensive data of the economy’s recovery after Covid restrictions were dropped late last year, infection waves began easing and businesses returned to normal after the Lunar New Year holidays. The figures add to other signs of a rebound in the economy and put policymakers in a good position ahead of next week’s National People’s Congress, where a new growth target will be disclosed.

While there were “significant seasonal and event factors” influencing the PMI figures, the “overall trend still points to a solid recovery at the beginning of 2023,” said Zhou Hao, chief economist at Guotai Junan International. “The decent PMI readings provide a positive note for the upcoming National People’s Congress,” with the government expected to roll out further supportive policies to cement the recovery, he said.

The data buoyed stocks and fueled a rally in commodities. The Hang Seng China Enterprises Index, which tracks Chinese companies listed in Hong Kong, rose 5.1%, while the offshore yuan gained as much as 1%. West Texas Intermediate oil swung from an earlier decline and was up 0.7% as of 8:56 a.m. in London. Copper rose 1% on the London Metal Exchange, while aluminum, iron ore and zinc also climbed.

While investors have focused Wednesday on the signs of recovery, the NPC next week is proving to be a source of uncertainty. President Xi Jinping is moving to consolidate the Communist Party’s hold over the world’s second-largest economy, with plans for sweeping changes to China’s bureaucracy and more influence within private companies, including reforms for the financial sector.

Economists have also cautioned that even as the improving factory data suggests the recovery is becoming more balanced, there are still headwinds, as global demand remains weak and exports will likely contract this year.

What Bloomberg Economics Says ...

“Taking into account January’s strong PMI readings, the data show the recovery is outpacing the rebound at a comparable stage in early 2020 after the national lockdown was lifted. Looking ahead, it will be hard to keep up this brisk pace, with global growth slowing and pent-up demand after Covid reopening likely to fade. Still, with policy swinging toward growth support, the recovery should sustain momentum into the second quarter.”

— Chang Shu and Eric Zhu, economists

Read the full report here.

Other data has signaled a pickup in domestic demand. China’s home sales rose in February from a year earlier, the first such increase since June 2021 as policymakers expanded support for the sector. Road congestion in major cities has increased, subway ridership has returned to pre-pandemic levels and restaurant and mall spending has risen.

The initial Covid wave following the ending of pandemic restrictions has now subsided, boosting February’s PMI numbers, according to Zhao Qinghe, a senior statistician at the NBS. Measures to stabilize growth in the country have also started to take effect, Zhao added.

A separate, private PMI survey focused on smaller companies also showed improvement in February, rising to 51.6 from January’s 49.2. That increase in the Caixin Manufacturing Purchasing Managers’ Index was driven by pickups in both supply and demand as production gradually returned to normal, Caixin and S&P Global said in a statement Wednesday.

China’s rebound is also giving a boost to manufacturing in other parts in Asia. PMIs in Thailand, Vietnam and other Southeast Asian producers climbed last month. In North Asia, the picture was more mixed, with Japan’s factory activity falling, while Taiwan’s PMI rebounding, but remaining below 50.

Top leaders in China have pledged to prioritize growth this year, placing an emphasis on the role that domestic demand will play in driving the recovery. The People’s Bank of China said in its latest monetary report that it would provide “sustainable” support for the real economy and refrain from using “flood-style” stimulus.

A recovery in economic growth this year will lead to an improvement in local governments’ fiscal conditions, Finance Minister Liu Kun said during a briefing on Wednesday. China will moderately expand fiscal spending in 2023 to ensure the overall level of government investment won’t decline, he said.

“The latest economic data suggests China’s reopening has been working well,” said Nicolas Wang, senior equity adviser at Union Bancaire Privée. Still, “with regard to the NPC outcome, the market seems to be lowering expectations on the stimulus plan, which has been priced in by the equity market to some degree.”

Other details of the PMI can be found here.

--With assistance from Shikhar Balwani, Wenjin Lv, Sofia Horta e Costa, Andrew Janes, John Cheng, Chester Yung and Yujing Liu.

(Updates with details on the upcoming NPC and the latest market data.)

©2023 Bloomberg L.P.