Sep 14, 2023

China Gold Premium Hits Record as Beijing Defends Yuan

, Bloomberg News

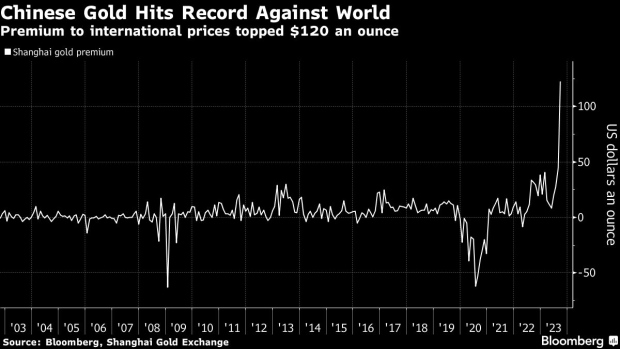

(Bloomberg) -- Gold in China is trading at a record premium to international prices, a sign of Beijing’s escalating battle to defend its currency.

Bullion on the Shanghai Gold Exchange traded at a premium of more than $120 an ounce on Thursday, according to calculations by Bloomberg. That’s the highest since the exchange was founded over two decades ago, as a weak yuan drove up prices in recent weeks.

Traders have sold the yuan this year as disappointing economic data and real estate turmoil spurred the central bank to cut interest rates. As monetary policy diverges with the rest of the world, sending the currency toward record lows offshore, the central bank has intervened to stem the slide. That includes limiting gold shipments into the local market by squeezing import quotas.

“It looks as if there’s been no imports,” said Rhona O’Connell, an analyst at StoneX. “That also makes sense because of the efforts that they are putting in to defend the currency.”

Read More: Yuan Bears Feel Heat of PBOC Defense as Funding Costs Surge

Investors have been buying domestic gold and selling international ones in an arbitrage trade, since speculations on gold import restrictions started in June, said Liu Yuxuan, an analyst with Guotai Junan Futures, from Shanghai.

China is the world’s biggest market for bullion, with rich and poor citizens alike buying gold as a savings tool. Demand for gold in the country has remained largely subdued this year, until recently when the weaker yuan and economy started to boost purchases.

“The jump in premium is also due to relatively strong buying for gold in China, amid weak maco economic sentiment.” said Liu.

--With assistance from Winnie Zhu.

(Update to add the fifth and seventh paragraphs of analyst comments)

©2023 Bloomberg L.P.