Mar 14, 2024

China Home Prices Fall at Slower Pace as Policy Support Mounts

, Bloomberg News

(Bloomberg) -- China’s home prices continued to fall in February, underscoring the challenge for authorities as they step up efforts to salvage the beleaguered market.

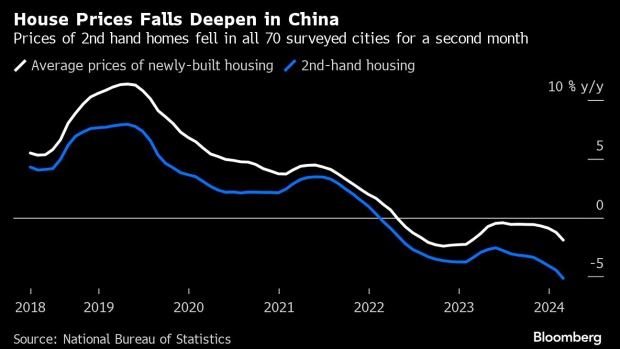

Declines in prices of both new and used homes deepened in February from a year earlier, even as they eased slightly on a month-on-month basis, National Bureau of Statistics figures showed Friday.

Arresting the slump in values is key to reviving homebuyer demand, which would help developers by providing much-needed cash to repay debts. The liquidity crisis has reached another low as state-backed China Vanke Co., the country’s second-largest developer by sales, fights to avoid its first-ever default.

New-home prices in 70 cities, excluding state-subsidized housing, fell 1.9% from a year earlier, steeper than January’s 1.2% drop. They slid 0.36% from January, when they retreated 0.37%.

Existing-home prices dropped 5.2% year on year, worsening from 4.5% in January and falling in all 70 cities. They declined 0.62% month on month, improving from a 0.68% decrease in January.

More details on the price report here

Declines in prices of new homes are “showing no signs of ebbing,” said Kelvin Lam, a senior economist at Pantheon Macroeconomics. “The second-hand market continues to take a hammering.”

China’s three-year housing slump is dragging on growth in the world’s second-largest economy. The price declines are also adding to deflationary pressure that’s weighing on demand.

Read more: China Economy Likely Off to Muted Start as 5% GDP Goal in Focus

Chinese authorities have been stepping up support for the housing market by urging banks to provide financing for developers and allowing local governments to ease rules for homebuyers. That has yet to revive new-home sales, which slumped 60% last month from a year earlier, private data show. China Vanke posted its biggest sales decline in six years.

The nation’s housing minister said last week that China still faces a “severe task” to stabilize the market, acknowledging the current difficulty is related to issues with capital. Country Garden Holdings Co. faces a liquidation petition in Hong Kong, while China Evergrande Group was ordered to wind up in January.

Policymakers have increased pressure on banks to boost their property loans through so-called white lists, as developers struggle to complete projects. At the end of February, state-owned lenders had approved more than 200 billion yuan ($28 billion) of loans for property works eligible for support.

In another blow to developers, homebuyers have been shifting to the second-hand market due to falling prices and doubts over the timeline for the delivery of new apartments. Existing-home sales overtook new properties by area for the first time last year.

Bloomberg Economics analysis: Three Years Into Slump, Property Still Pricey

Market watchers caution that a sustainable sales rebound hinges on stronger policies. Now that the central government has given local officials ample autonomy, they should “bear the responsibility” to tweak rules to stabilize the market, housing minister Ni Hong said last week.

“Further supportive policies may still be needed,” said Lynn Song, chief economist for Greater China at ING Bank. “Establishing a trough for house prices would go a long way towards stabilizing sentiment.”

Existing property values edged up in only two cities in February from a month earlier, the statistics bureau figures showed. New-home prices gained in eight cities, fewer than 11 a month earlier.

More cities may see price gains in the new-home market in March, which is typically a busy season for sales, said Yan Yuejin, research director at E-house China Research and Development Institute. Oversupply may have eased after developers offered more discounts in February to boost sales during the Lunar New Year holiday, he said.

Some tier-2 cities have started to fully remove homebuying restrictions, raising expectations for more large cities to follow suit. Hangzhou no longer reviews buyers’ eligibility when they purchase pre-owned homes, state media reported this week.

--With assistance from Yujing Liu and James Mayger.

(Updates with year-on-year figures and comments from economists)

©2024 Bloomberg L.P.