Jan 15, 2023

China Home Prices Slump After Covid Outbreaks Stifle Rescue

, Bloomberg News

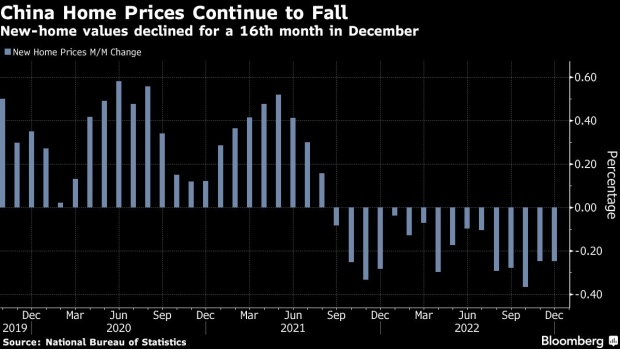

(Bloomberg) -- China’s home prices fell for a 16th month in December, as widespread Covid outbreaks complicated efforts to rescue the slumping property market.

New-home prices in 70 cities, excluding state-subsidized housing, declined 0.25% from a month earlier, the same pace as November, National Bureau of Statistics figures showed Monday. For the full year, prices dropped 2.3%, according to Bloomberg calculations.

The latest decline came weeks after policy makers unveiled a sweeping plan to revive the housing industry, focusing mainly on the supply side by pledging financial support to cash-strapped developers. Since then, officials have taken further steps to stimulate homebuyer demand and ensure the sector’s stable growth.

Yet those measures are being stifled by large-scale coronavirus outbreaks after the government suddenly abandoned its Covid Zero policy. Confidence among businesses and consumers has yet to recover to pre-pandemic levels.

“Struggling property developers get to breathe some air temporarily after Chinese authorities made efforts to ease their liquidity pressure,” said Esther Liu, credit analyst at S&P Global Ratings. “But the only path lifting them out of the current crisis is a revival of sales.”

The housing slump also continues to hurt the secondary market. Existing-home prices dropped 0.48% in December, bigger than the 0.44% decline a month earlier, the figures showed.

Lowering borrowing costs for homebuyers is one way policy makers are trying to boost demand. Authorities said this month that they will extend measures introduced in September allowing cities to lower mortgage rates for first-time buyers if new-home prices fall for three consecutive months.

But it’s unclear whether such steps are enough to revive a market that has seen sales drop since mid-2021.

Home prices will continue to fall in 2023 as homebuyers remain in a tight wait-and-see mode, according to a recent China Index Holdings survey of prospective buyers in 100 major cities. Listings of existing residences have continued to climb, weighing on second-hand prices, the property institution estimates.

©2023 Bloomberg L.P.