Oct 26, 2022

China Industrial Profits Decline Again on Covid, Property

, Bloomberg News

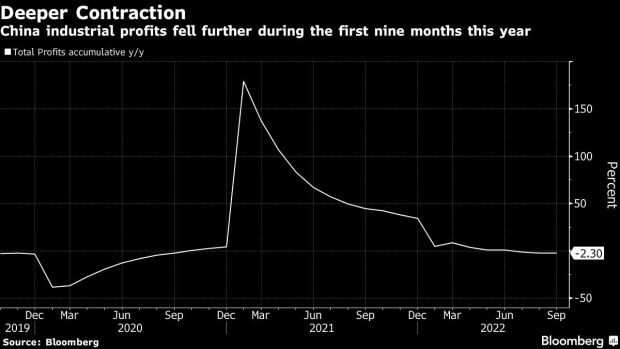

(Bloomberg) -- Profits at industrial firms in China shrank in the first nine months of the year, as Covid disruptions and a property slump continued to weigh on companies’ bottom lines.

Industrial profits in the January-to-September period fell 2.3% compared to the same time frame a year ago, data from the National Bureau of Statistics showed Thursday. That compared with a decline of 2.1% in the first eight months.

The NBS has not released single-month data since June.

Firms continue to be affected by high costs and some businesses face operational challenges, said Zhu Hong, a senior statistician at the NBS, in a statement accompanying the data, adding that profits are still impacted by an “increasingly complicated external environment.”

Profits at foreign companies remained weak, though the declines narrowed from the January-to-August period. Those profits were down 9.3% in the first nine months, compared to a 12% drop in the first eight months.

Private firms saw their profits sink 8.1% year-to-date, also slightly narrower. Profits at state-owned enterprises were up 3.8%, down from a 5.4% increase in the first eight months of 2022.

Auto manufacturing profits for the month of September were up more than 47% due to recovered supply chains and an increase in demand, according to the NBS. The monthly jump narrowed the year-to-date figure for that sector to a decline of 1.9% from a 7.3% plunge in the first eight months.

Third quarter gross domestic product and other data released earlier this week pointed to a stronger-than-expected rebound underpinned by increasing investment in infrastructure and an acceleration in manufacturing output growth.

Even so, economic risks remain as the country sticks to Covid Zero and as the housing market continues to be pressured. Retail sales, property and employment all showed signs of strain last month.

Trade data last month was also better than feared, but momentum is slowing and exports to many of China’s largest trade markets contracted -- evidence of a slowdown in global demand.

Read More: China’s Exports to Major Markets Slump, Russian Trade Strong

Commodity prices have also fallen, which in recent months has dragged on producer price inflation -- a measure strongly correlated with industrial profits. PPI slowed to 0.9% in September, driven by a slump in the prices of mining, raw materials and manufacturing goods.

Slowing inflation means some businesses may have more trouble passing on the cost of goods, which can cut into their margins.

Slack consumption and a lack of effective demand will continue, economists say, as long as Covid Zero remains in place -- the ultimate hurdle in a meaningful and lasting recovery.

However, President Xi Jinping signaled no change in direction for either that strategy or housing market policies, the other main economic risk factor, during the 20th Communist Party Congress this month. Xi extended his tenure as leader during the twice-a-decade event.

(Updates with additional data on firm breakdowns, more from NBS statement.)

©2022 Bloomberg L.P.