Jan 19, 2023

China Injects Record Amount of Cash This Week Before Holidays

, Bloomberg News

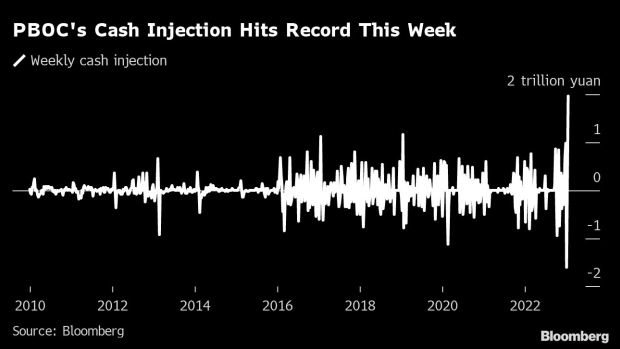

(Bloomberg) -- China’s central bank has pumped a record amount of short-term cash into the banking system this week as demand rose following the removal of Covid restrictions and ahead of the Lunar New Year holidays.

The People’s Bank of China added a net 1.97 trillion yuan ($291 billion) of cash this week via open market operations, a record high, according to data compiled by Bloomberg. That’s more than nine times the size of last week’s injection.

The large cash infusion is expected to ease China’s benchmark seven-day money-market rate, which rose to the highest in nearly a month this week amid cash withdrawals for gift giving and travel during the upcoming week-long holiday. Tax payments by corporates are also forecast to add to an estimated total cash deficit of some $148 billion.

“Repo fixings have gone up over the past one to two weeks, reflecting some temporary liquidity tightness heading into the long holiday that requires liquidity injection to smooth the funding conditions,” said Winson Phoon, head of fixed income research at Maybank Securities Pte in Singapore. “This could in part be due to the reopening effect, with a pickup in mobility and activity potentially increasing the demand for cash.”

While analysts expect the seasonal demand for cash to ease after the holiday, they expect money-market rates to stay under upward pressure as the economy recovers following China’s dismantling of Covid curbs.

China’s short-term money market rates will ease to “more normal levels” after the holidays as seasonal demand fades, said Frances Cheung, rates strategist at Oversea-Chinese Banking Corp. in Singapore. “We maintain an upward bias to yuan rates on re-opening and fiscal stimulus.”

Analysts still forecast the PBOC to keep its cash infusion measured based on its actions this week. While the central bank boosted short-term cash in view of the holidays, it has injected a smaller-than-expected 79 billion yuan this month via medium-term loans. Chinese banks also maintained their benchmark lending rates for a fifth straight month.

With the focus on growth the “PBOC will conduct open market operations to guarantee sufficient liquidity in the system,” said Kiyong Seong, lead Asia macro strategist at Societe Generale in Hong Kong. However, it won’t be flooding the market with funds, he added.

PBOC Deputy Governor Xuan Changneng said last week that the central bank will avoid unleashing massive monetary stimulus into the economy this year as it seeks to strike a balance between boosting growth, creating jobs and maintaining price stability.

--With assistance from Masaki Kondo.

©2023 Bloomberg L.P.