Apr 28, 2022

China Locks Down Part of Its Northern Hub for Coal Shipping

, Bloomberg News

(Bloomberg) -- The northern port of Qinhuangdao is the latest Chinese commodities hub to get hit by virus-related lockdowns.

The city in Hebei province has locked down its Haigang district, which includes the port, after infections were found in the area, although a spokesperson said the port is operating normally. In the first quarter, Qinhuangdao handled nearly 50 million tons of goods, mostly coal from the interior and metal ore imports. Hebei is China’s biggest steel province and its mills rely on seaborne supplies of iron ore.

The city is chiefly known as a transition point for sending coal from the mining regions of the north to the coastal industrial centers in the south. The price set at the port is an important benchmark for China’s coal market, which is the largest in the world.

While port administrators are working remotely, workers are on site and coal is being transported normally, the spokesperson said. Still, coal flows have drawn particular scrutiny in recent weeks as markets in the south stress over dwindling imports and a resurgent virus that has clogged up transportation of the nation’s mainstay fuel.

Much of the Chinese economy was crippled by an unprecedented power crunch in the fall. Earlier this month, an executive at the China Coal Transportation and Distribution Association said eight coastal provinces, including economic powerhouse Guangdong, are threatened once again by a growing shortfall of the fuel for industry and cooling needs. Miners in the top producing province of Shanxi have since been told to guarantee supplies to the at-risk areas, according to a report.

Earlier this week, Baotou, the biggest city in Inner Mongolia, China’s No. 2 coal region, was locked down. Baotou is also a crucial hub for the production of rare earths.

Today’s Events

(All times Beijing unless shown otherwise.)

- Webinar on Zero-Carbon Transition for China’s Chemical Industry, 14:00

- China Coal 1Q online earnings briefing, 15:00

- Cnooc 1Q earnings call, 17:35

- China Offshore Wind Power Conference, Guangzhou, day 3

- EARNINGS: Gotion High-Tech, China Moly, China Oilfield Services, Jiangxi Copper, Anhui Conch, Baosteel, Cnooc, Datang Power, Sany Heavy, Komatsu, Caterpillar, Syngenta

- USDA weekly crop export sales, 08:30 EST

- Glencore quarterly production report

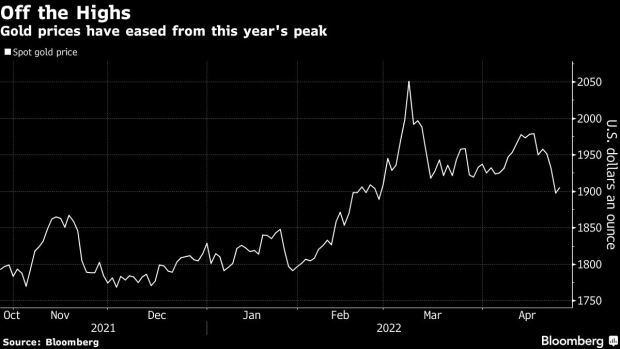

Today’s Chart

Global demand for gold jewelry this year will probably be undermined by China’s stringent lockdowns to combat its Covid-19 outbreaks, according to the World Gold Council. The seasonal ebb in Chinese consumption that normally occurs in the second quarter may be exacerbated as the virus measures deter buyers in the world’s biggest consumer.

On The Wire

China’s biggest oil refiner Sinopec is confident demand will recover by the end of the second quarter and still reach full-year growth despite taking a hit from pandemic measures.

- China Shenhua Gains After Reporting 67% Earnings Growth in 1Q

- PetroChina’s Outlook on Oil Rally, Gas Price Hikes Key: Preview

- China’s Xiangguang Copper to Restart After Rescue Agreement

- Electric Car Demand Behind 8,000% Jump in Net Cash Flow for BYD

- BYD’s 1Q Earnings “Very Strong”, Sales to Outform Sector: Citi

- China Oil Inventories Keep Swelling as Lockdowns Hurt Demand

- Fortescue’s 3Q Shipments Rise 10% as Iron Ore Project Ramps Up

- Mortgage Rates Lowered in Over 100 China Cities: Securities News

- Trina Solar 1Q Net Income 543.2M Yuan Vs. 230.2M Yuan Y/y

- Trina Solar FY Net Income 1.8B Yuan Vs. 1.23B Yuan Y/y

- Peru Ousts Protesters From Stalled Las Bambas Copper Mine

- New Hope Liuhe FY Net Loss 9.59B Yuan Vs. Profit 4.94B Yuan Y/y

- China’s Refined-Oil Product Inventory Leap Spawns Export Rethink

The Week Ahead

Friday, April 29

- China Caixin factory PMI for April, 09:45

- Shenhua Energy 1Q online earnings briefing, 11:00

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- EARNINGS: Tianqi Lithium, Yangtze Power, PetroChina, Maanshan Steel, JA Solar

Saturday, April 30

- China official PMIs for April, 09:30

- EARNINGS: CATL

©2022 Bloomberg L.P.