Dec 19, 2023

China Pulls Punches to Keep Pricey Electric Cars Flowing to EU

, Bloomberg News

(Bloomberg) -- When the European Union launched a probe into Chinese support for electric vehicles, the bloc’s carmakers braced for painful retaliation from the increasingly assertive superpower.

The dire reprisal hasn’t materialized, at least yet. Beyond some initial strong words from China, both the government and companies like BYD Co. and SAIC Motor Corp. have cooperated since the start of the subsidy investigation. The muted response points to the pressure China’s oversupplied EV market is under, made worse by the price war Tesla Inc. touched off over the last year.

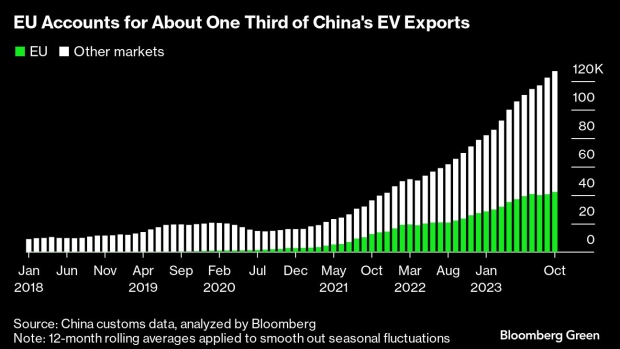

After years of frenetic development in China, local carmakers are shipping a rising number of EVs to Europe, following a number of failed attempts to win customers in the home of Volkswagen AG and Renault SA. While its Chinese manufacturers’ market share in Europe is still low, dominance in plug-in vehicle production has put the country in position to challenge Japan for the global lead in automotive exports.

“The Chinese would be shooting themselves in the foot if they were to retaliate and worsen relations with one of their biggest trading partners,” said Matthias Schmidt, an independent auto analyst near Hamburg. “China has arrived at a point where they need to start selling more cars outside of their borders.”

EVs made in China, such as BYD’s Dolphin compact crossover and SAIC-owned MG Motor’s MG 4, fetch roughly double on average in Europe compared to their home region, customs data show. The price disparity stems from factors including China’s low labor costs and generous subsidies, and the additional costs companies have to absorb when sending cars overseas, including tariffs and shipping expenses.

The Dolphin, on display at September’s car show in Munich, retails from 111,000 yuan ($15,500) in China. Buyers in Germany have to fork out €35,990 ($38,780), though that’s still well below the entry price for VW’s ID.3. In Thailand, where EVs are starting to take off, customers pay the equivalent of $19,560 for an entry-level Dolphin.

It’s similar at MG Motor. The Chinese brand with British cachet has been building a presence in Europe for over a decade and is leading among Chinese marques in the region. The MG 4, made in Ningde, Fujian province, sells at €37,700 in Germany — €20,000 more than in China.

Tesla’s Shanghai-made Model 3 is about €13,000 more expensive in the EU than in China.

Keeping the door open to lucrative Europe matters now more than ever, with the US largely off limits because of a 25% import tariff and generous purchasing incentives only available for vehicles made in North America. At stake is the future of hundreds of unprofitable EV makers that have sprung up in the wake of sweeping government subsidies and inner-city driving restrictions.

The fight for survival is well underway. Nio Inc., once a leader among China’s EV newbies and exporting models like the €59,900 ET5 sedan to Europe, is considering more staff cuts after an initial round shedding 10% of its workers. The company this week got another cash injection from the Middle East. WM Motor has filed for bankruptcy after getting pushed to the sidelines in the cutthroat competition.

In China, the glut of EVs is unlikely to ease with BYD ratcheting up sales of EVs and plug-in hybrids by 65% through November, putting the local leader on track for 3 million units this year. At the same time, rising personal debt and slower income growth triggered by the country’s lengthy pandemic lockdowns and property sector crisis has capped spending.

“The Chinese government gave some support in the early stages of this industry, but it’s gradually winding down now,” said Xu Haidong, deputy chief engineer of China Association of Automobile Manufacturers. “Overseas manufacturers started later and their products and technology are relatively behind,”

Read more: ‘Stakes Are High’ as China Has Tools to Strike Back at EV Curbs

The EU’s probe kicked off in earnest in October with investigations of BYD, SAIC and Geely, bringing the bloc more in line with the US in looking to protect an industry that employs millions of workers. While the EU is pursuing extra duties, the US is dishing out a swath of subsidies to attract investments with strict rules on local supply chains and EV making to qualify for incentives.

“The US and the EU are united in that they don’t want the transition to EVs to be a transition to Chinese EVs,” said Brad Setser, a senior fellow at the Council of Foreign Relations. “An amended Inflation Reduction Act in the US allowing European carmakers the same access would help with a coherent, combined response.”

Initial tariffs could come as early as July, with any final decision requiring approval from member states. In recent probes of other sectors such as e-bikes and fiber-optic cables, the EU discovered subsidy margins ranging from 4% to 17%. Any punitive EV tariffs would come on top of a current 10% import duty.

The investigation into Chinese EV aid marked a low point for the country’s souring trade relations with Western nations, led by the US. Tensions between Beijing and Brussels have flared over efforts by Europe to “de-risk” its supply chains and the EU’s worsening trade deficit with China at more than $400 billion last year.

Read more: China’s Stranglehold on EV Supply Chain Will Be Tough to Break

At this month’s trade talks, the first in-person summit in four years, Chinese officials took a non-aggressive stance. President Xi Jinping told EU leaders that he wants the two sides to be key trade partners capable of building trust over supply chains. China’s ministry of commerce separately said the EU should stop trade protectionism through the EV probe.

To be sure, Western carmakers including Tesla, Renault and BMW would likewise be hit by higher duties as they ship cars from the world’s biggest auto market to Europe.

China’s stance could also shift should tariffs be imposed, with painful consequences for global carmaking. BMW, Mercedes-Benz and VW sell between 33% to 40% of their vehicles there, and no manufacturer can get get by without China’s EV batteries and other components. In a potential foretaste in October, China restricted exports of graphite, used to make batteries.

“The most obvious option to retaliate would be to take the import tariff into China from 15% back to 25%,” said Setser. “China would be well within its right to do so.”

©2023 Bloomberg L.P.