Jun 9, 2023

China’s Central Bank Governor Reiterates Stable Policy Stance

, Bloomberg News

(Bloomberg) -- China’s central bank will keep monetary policy targeted and ensure credit growth is stable, Governor Yi Gang said, keeping the policy stance largely unchanged despite rising calls for more stimulus.

Speaking to businesses and banks in Shanghai, Yi said he has confidence the official growth target of around 5% can be achieved this year. Inflation is expected to gradually rebound in the second half of the year, he added. The speech was earlier this week and posted on the People’s Bank of China’s website on Friday.

Various monetary policy tools will be used to keep liquidity reasonably ample, Yi said. The PBOC will continue to maintain targeted and forceful monetary policy, he said, repeating language from previous statements. At the same time, he hinted at some flexibility, saying “counter-cyclical adjustments” will be strengthened.

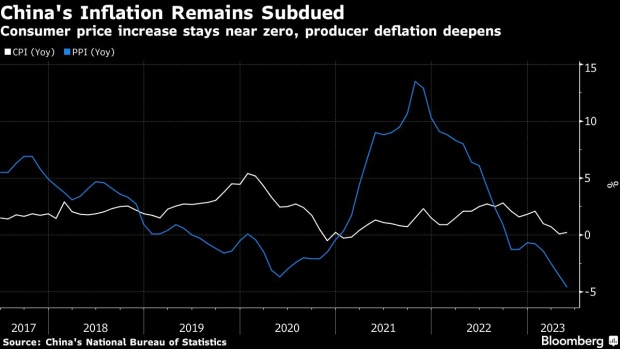

A weakening in the economy’s recovery and inflation close to zero have fueled calls for more easing, including interest rate cuts. A prominent economist and government adviser, Liu Yuanchun, was the latest to argue for lower rates to help ease financing costs for businesses.

Yi appeared to downplay risks of deflation, saying the economy is still in recovery from the pandemic, and there’s a time lag between the rebound in demand and supply. He attributed the slowdown in inflation in recent months to the weaker recovery in demand, along with a high base of comparison from last year for energy and vegetable prices.

Consumption growth has picked up this year, he said, which will be transformed to income for companies and more hiring, and in turn, help to drive further spending. The economy’s year-on-year growth in the second quarter will be strong, mainly due to base effects, and the consumer price index will likely rise to above 1% in December, he said.

Yi vowed to strengthen financing support for weak sectors in the economy, including private firms and small businesses, as well as industries that are key to stabilizing employment, such as the services sector.

Representatives from companies including China Baowu Steel Group Corp., automaker SAIC Motor Corp., China Construction Bank Corp. and Citigroup Inc. attended the meeting with Yi, according to the statement. Yi also visited China Baowu Steel during his visit to Shanghai from Wednesday.

(Updates with additional details throughout.)

©2023 Bloomberg L.P.